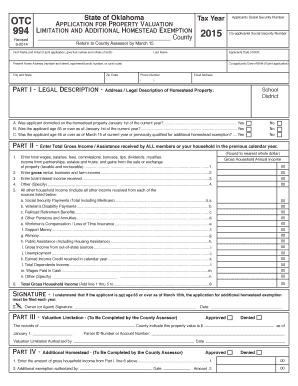

Get Ok Otc 994 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OK OTC 994 online

How to fill out and sign OK OTC 994 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can turn into a major issue and a serious hassle if proper assistance is not provided. US Legal Forms was developed as an online resource for OK OTC 994 e-filing and provides multiple benefits for taxpayers.

Utilize the advice on how to complete the OK OTC 994:

Use US Legal Forms to ensure a comfortable and straightforward OK OTC 994 completion.

- Acquire the blank form on the website in the designated section or through a search engine.

- Press the orange button to launch it and wait until it’s finished.

- Review the form and follow the guidelines. If you have never completed the example before, follow the line-by-line instructions.

- Focus on the highlighted fields. These are fillable and require specific information to be entered. If you are uncertain about what information to provide, refer to the instructions.

- Always sign the OK OTC 994. Use the built-in tool to generate the e-signature.

- Select the date field to automatically insert the correct date.

- Reread the form to review and revise it before the e-filing.

- Click the Done button on the upper menu once you have finished it.

- Save, download, or export the completed form.

How to modify Get OK OTC 994 2015: personalize forms online

Utilize our extensive online document editor while preparing your forms. Complete the Get OK OTC 994 2015, highlight the most significant details, and effortlessly make any additional required adjustments to its content.

Handling documents digitally is not only efficient but also provides a chance to change the template according to your requirements. If you're set to manage the Get OK OTC 994 2015, consider filling it out with our extensive online editing tools. Whether you make a mistake or input the requested information in the wrong section, you can easily modify the form without needing to restart from scratch as you would during manual completion. Furthermore, you can emphasize the crucial information in your document by highlighting specific sections with colors, underlining them, or encircling them.

Our powerful online solutions represent the simplest way to finalize and personalize Get OK OTC 994 2015 based on your requirements. Use it to prepare personal or business documents from any location. Access it in a browser, modify your forms, and return to them anytime in the future - all will be securely stored in the cloud.

- Launch the file in the editor.

- Input the necessary details in the blank spaces using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t overlook any important areas in the template.

- Encircle some vital details and add a URL to it if required.

- Employ the Highlight or Line tools to emphasize the most important facts.

- Choose colors and thickness for these lines to make your form appear professional.

- Remove or black out the information you prefer to keep hidden from others.

- Replace sections of content containing errors and input the text you need.

- Conclude modifications with the Done button once you confirm everything is accurate in the document.

Get form

Related links form

Seniors do not completely stop paying taxes but can benefit from several reductions and exemptions. In Oklahoma, programs such as the OK OTC 994 can significantly reduce the tax burden. It is important to understand that while property taxes can be mitigated, property owners are still responsible for other taxes. Staying informed about available benefits helps seniors manage their financial responsibilities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.