Loading

Get Ph Bir 2000-ot 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2000-OT online

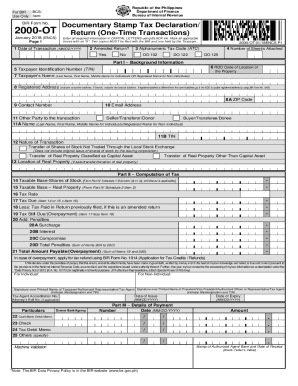

Filling out the PH BIR 2000-OT form, which serves as a declaration for documentary stamp tax for one-time transactions, is an essential process for taxpayers in the Philippines. This guide will provide you with clear and detailed steps to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the PH BIR 2000-OT online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the date of transaction in the format MM/DD/YYYY in the designated field.

- Indicate whether you are filing an amended return by marking the appropriate box for 'Yes' or 'No'.

- Input the alphanumeric tax code (ATC) relevant to your transaction from the provided options.

- Specify the number of sheets you are attaching to this form.

- Complete Part I with your background information, including your taxpayer identification number (TIN), name, registered address, and contact details.

- Provide the information of the other party involved in the transaction, including their TIN and nature of the transaction.

- In Part II, compute the taxable base for shares of stock or real properties as applicable and input the relevant values.

- Calculate the tax due by multiplying the taxable base by the applicable tax rate.

- If this is an amended return, subtract any tax previously paid from the total tax due to determine tax still due or overpayment.

- Complete the penalties section if applicable, indicating any surcharges, interests, or compromises.

- Review your entries for accuracy before finalizing the form.

- Once completed, save your changes, download the form, and prepare it for printing or sharing.

Start completing your PH BIR 2000-OT online today to ensure compliance with your tax obligations.

Related links form

Fill-up applicable fields in the BIR Form No. 1700. Pay electronically by clicking the "Proceed to Payment" button and fill-up the required fields in the "eFPS Payment Form" click "Submit" button. Receive payment confirmation from eFPS-AABs for successful e-filing and e-payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.