Loading

Get Sba 2483 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 2483 online

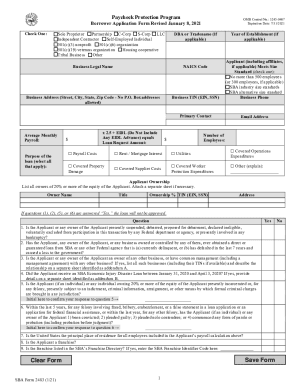

Completing the SBA 2483 form online is essential for applicants seeking assistance through the Paycheck Protection Program. This guide provides a clear and comprehensive walkthrough of each section of the form, ensuring a smooth and efficient application process.

Follow the steps to successfully complete the SBA 2483 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing interface.

- Select your business type by checking one of the provided options such as Sole Proprietor, Partnership, or Nonprofit.

- Fill in the DBA or Tradename if applicable, along with the Year of Establishment, and the Legal Business Name.

- Enter the NAICS Code that matches your business activity, along with the full Business Address, including Street, City, State, and Zip Code (note: P.O. Box addresses are not allowed).

- Provide the Business TIN (Tax Identification Number) and the primary contact details including Business Phone and Email Address.

- Indicate the Average Monthly Payroll amount and select the Purpose of the loan from the available options.

- Calculate the Loan Request Amount by multiplying the Average Monthly Payroll by 2.5 and adding any EIDL amount, noting not to include any EIDL Advance.

- List the Number of Employees and clarify the purpose of the loan by checking all applicable boxes.

- Document all owners of 20% or more equity in the Applicant's business, including their names, titles, ownership percentages, TINs, and addresses.

- Respond to the eligibility questions, initialing where required, and ensure all information is truthful and accurate.

- Sign and date the form, providing the title and printed name of the authorized representative.

- Review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Start filling out your SBA 2483 form online today to secure your loan assistance.

Related links form

An SBA loan that helps businesses keep their workforce employed during the Coronavirus (COVID-19) crisis. The Paycheck Protection Program (PPP) provides loans to help businesses keep their workforce employed during the Coronavirus (COVID-19) crisis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.