Get Ca Ftb 540 Instructions 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540 Instructions online

Filling out your California Form 540 can seem daunting, but with the right guidance, you can navigate the process smoothly. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring that you provide all necessary information accurately.

Follow the steps to fill out your Form 540 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing your federal income tax return. Use the information from your federal return to fill out Form 540.

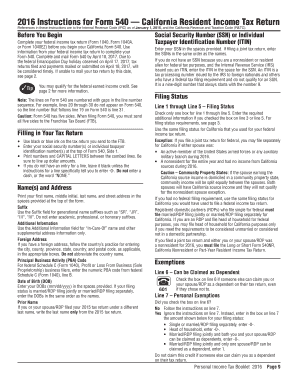

- At the top of Form 540, Side 1, enter your social security number or individual taxpayer identification number. Ensure that you use black or blue ink.

- In the 'Name(s)' section, enter your first name, middle initial, last name, and street address as required.

- Fill in the 'Filing Status' section by selecting the appropriate option based on your federal tax return. Remember to read any special instructions related to your status.

- Complete the 'Exemptions' section accurately. Ensure that you check the box if someone else can claim you as a dependent.

- For 'Income', refer to your W-2 forms and enter your state wages and federal adjusted gross income as outlined in the instructions.

- Continue to fill out any remaining sections regarding California adjustments, deductions, and tax credits as applicable.

- Once you have filled out the necessary sections, review the form for accuracy and completeness.

- Save your changes in the editor, and then download, print, or share your completed Form 540 as needed.

Start completing your Form 540 online today for a streamlined filing experience.

Get form

Related links form

Yes, you can file CA 540 online through various tax preparation platforms approved by the California Franchise Tax Board. Filing online is a convenient option that may save you time and ensure accuracy by performing automated calculations. Additionally, many of these platforms provide access to the CA FTB 540 Instructions and guidance throughout the filing process, making it a user-friendly experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.