Get Ca Ftb 540 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540 online

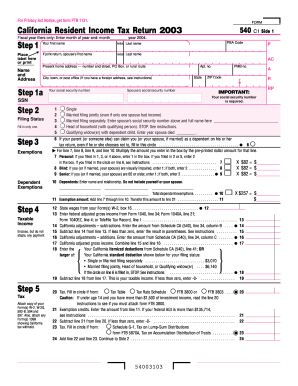

The CA FTB 540 is the California Resident Income Tax Return form that allows residents to report their income and calculate their tax liability. This guide provides a comprehensive overview and step-by-step instructions on how to accurately complete this form online.

Follow the steps to fill out the CA FTB 540 online.

- Press the ‘Get Form’ button to access the CA FTB 540 form and open it in your browser.

- Fill in your personal information in the 'Name and address' section, including your first name, initial, last name, and your spouse's details if applicable. Ensure to include your complete home address, including city and ZIP code.

- Enter your social security number (SSN) and your spouse’s SSN if filing jointly. This information is vital for tax processing.

- Select your filing status. Choose only one option among single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Make sure to read the instructions closely to verify which status applies to you.

- List any exemptions you may qualify for. Complete the exemptions section, including personal and dependent exemptions, as indicated on the form.

- In the taxable income section, gather your income information from W-2 and 1099 forms. Enter your state wages, federal adjusted gross income, and applicable adjustments.

- Calculate your tax using the provided tax tables or rate schedule and enter the calculated amount.

- List any credits you may qualify for under the credits section. This may include renter's credit or other relevant state credits.

- Calculate and enter any overpaid tax or tax due. Ensure to verify the totals carefully.

- If applicable, fill out the contributions section for any funds you wish to donate. Sum these up as total contributions.

- Complete the refund or amount due section. If you are expecting a refund, provide details for direct deposit including your bank routing number.

- Finally, review all entries for accuracy. After ensuring everything is correct, you can save changes, download, or print the completed form for submission.

Complete your CA FTB 540 online today for a streamlined tax filing experience.

Get form

Related links form

A California partnership return must be filed by any partnership that conducts business in California or has income derived from California sources. All partnerships must submit Form 565 annually, providing a breakdown of income, deductions, and other essential details. This helps inform the state about the partnership's financial activities. If you are involved in a partnership, ensure that this requirement aligns with your CA FTB 540 obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.