Get Ma Dor 1-nr/py 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR 1-NR/PY online

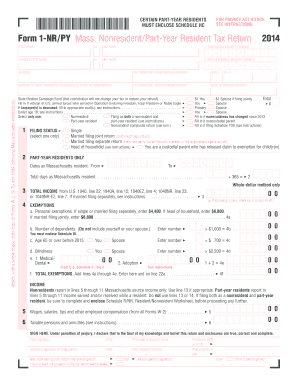

The MA DoR 1-NR/PY form is essential for nonresidents and part-year residents who need to file their Massachusetts state tax return. This guide provides a clear and supportive walkthrough to help you complete the form accurately and efficiently online.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to download the MA DoR 1-NR/PY form and open it in your preferred online document editor.

- Begin filling out your personal information, including your first name, middle initial, last name, and social security number. Ensure accuracy in this section to avoid delays.

- Enter your address, including city, state, ZIP code, and if applicable, your spouse's details. Be sure to also indicate the address of your legal residence.

- Complete the filing status section by selecting your appropriate options for marital status and residency status (nonresident, part-year resident, etc.).

- If applicable, provide your dates of residence in Massachusetts in the section dedicated to part-year residents.

- Report your total income, detailing all sources and amounts from appropriate lines on your federal tax return.

- Calculate exemptions, including personal exemptions and dependents. Enter these amounts carefully based on your filing status.

- Proceed to enter your deductions, ensuring that they align with the income reported.

- Calculate your total taxable income, applying any limits as described in the instructions.

- Review the form for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Complete your MA DoR 1-NR/PY form online today for an easier filing experience.

Get form

A Massachusetts resident is someone who lives in the state for more than 183 days a year, while a nonresident does not meet this criterion but may earn income from the state. This distinction affects your tax liabilities and the forms you need to file. Residents file different forms than nonresidents, typically using Form 1 rather than the MA DoR 1-NR/PY. Understanding your residency status is vital for proper tax compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.