Get Ma Dor 1-nr/py 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR 1-NR/PY online

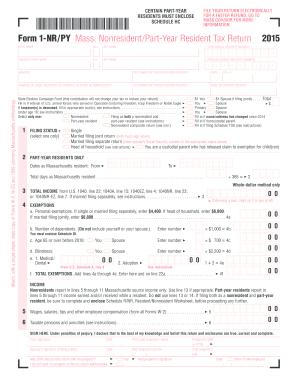

Filling out the MA DoR 1-NR/PY, or the Massachusetts Nonresident/Part-Year Resident Tax Return, can be a straightforward process with the right guidance. This form is essential for people filing taxes who lived in Massachusetts for part of the year or earned income there as nonresidents. This guide will provide clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to fill out your MA DoR 1-NR/PY online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information in the designated fields, including first name, middle initial, last name, and Social Security number. If applicable, provide your spouse’s information as well.

- Fill in your legal residence address, including city, town, state, and zip code. If you are filing as a nonresident, ensure to provide your legal domicile address.

- Complete the filing status section by selecting one option that best describes your tax situation: single, married filing jointly, married filing separately, or head of household.

- If you are a part-year resident, indicate the dates you were a Massachusetts resident and calculate the total days of residency.

- Report your total income, ensuring to focus only on Massachusetts source income if you are a nonresident.

- Enter personal exemptions in the designated area based on your filing status. Make sure to include any applicable deductions.

- Complete the deductions section accurately, providing information as required about any amounts you paid to Social Security or Medicare.

- Sign and date the form at the appropriate section, ensuring compliance with perjury declarations.

- Finally, review the completed form, save any changes, and choose to download, print, or share the form as necessary.

Start filling out your MA DoR 1-NR/PY online today for a smoother tax filing experience!

Get form

To avoid underpayment penalty taxes, regularly review your income and ensure you are making estimated tax payments based on your earnings. Utilize the resources available on the USlegalforms platform to help you calculate your tax liability accurately under the MA DoR 1-NR/PY requirements. Consistent assessment and timely payments significantly reduce your risk of incurring penalties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.