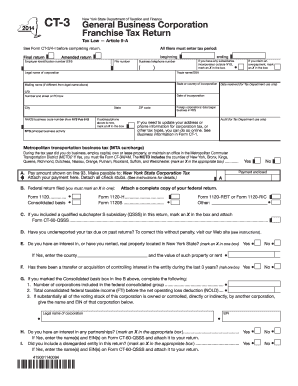

Get Ny Dtf Ct-3 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-3 online

How to fill out and sign NY DTF CT-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own taxes and also to complete forms online.

The US Legal Forms digital platform facilitates the e-filing of the NY DTF CT-3 efficiently and comfortably.

Ensure that you have accurately filled out and submitted the NY DTF CT-3 by the deadline. Review any relevant periods. If you provide incorrect information on your financial statements, it may result in serious penalties and complications with your yearly tax return. Utilize only authorized templates from US Legal Forms!

- View the PDF template in the editor.

- Observe the highlighted fillable sections where you can enter your details.

- Select the appropriate option upon seeing the checkboxes.

- Navigate to the Text icon along with various advanced features to manually adjust the NY DTF CT-3.

- Review all the details prior to finalizing your signature.

- Create your distinct eSignature using a keyboard, camera, touchpad, computer mouse, or smartphone.

- Authenticate your PDF document electronically and input the specific date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to revise Get NY DTF CT-3 2014: personalize forms online

Your easily adjustable and customizable Get NY DTF CT-3 2014 template is at your fingertips. Utilize our collection featuring an integrated online editor.

Do you delay finishing Get NY DTF CT-3 2014 because you simply don’t know where to start and how to progress? We empathize with your feelings and have a fantastic solution for you that is unrelated to battling your procrastination!

Our online inventory of ready-to-modify templates enables you to sift through and select from thousands of fillable forms tailored for various applications and scenarios. However, obtaining the document is merely the initial step. We provide you with all the essential tools to complete, certify, and alter the form of your choice without departing from our site.

All you need to do is access the form in the editor. Review the wording of Get NY DTF CT-3 2014 and confirm if it’s what you’re seeking. Begin tweaking the template by utilizing the annotation features to give your form a more structured and organized appearance.

In conclusion, alongside Get NY DTF CT-3 2014, you will receive:

With our professional tool, your finalized documents will always be legally binding and completely encrypted. We assure to protect your most confidential information.

Acquire what is necessary to generate a professional-looking Get NY DTF CT-3 2014. Make a wise choice and try our system now!

- Add checks, circles, arrows, and lines.

- Emphasize, obscure, and amend the existing text.

- If the form is intended for other users as well, you can insert fillable fields and distribute them for other parties to complete.

- Once you’re finished altering the template, you can download the document in any desired format or choose from various sharing or delivery options.

- A comprehensive suite of editing and annotation tools.

- An incorporated legally-binding eSignature capability.

- The option to devise documents from scratch or based on the previously uploaded template.

- Compatibility with diverse platforms and devices for enhanced convenience.

- Numerous options for protecting your documents.

- A broad array of delivery methods for more streamlined sharing and dispatching of files.

- Adherence to eSignature regulations governing the use of eSignature in electronic transactions.

Get form

The General Corporation Tax (GCT) rate in New York City is typically set at 8.85%. This rate applies to the taxable income of corporations doing business within the city limits. It's essential to stay up to date with any changes to tax laws to avoid complications. Properly filing the NYC CT-3 ensures that your corporation reflects its GCT liability accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.