Loading

Get Cr 0100ap (06/10/20) 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CR 0100AP (06/10/20) online

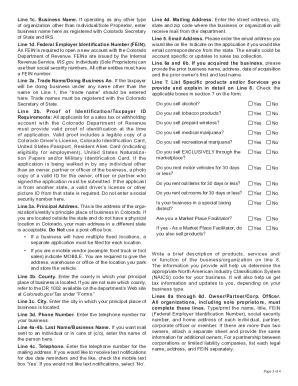

Completing the CR 0100AP form online is an essential step for individuals and organizations seeking to open a sales tax and withholding account in Colorado. This guide provides clear, step-by-step instructions to help users navigate the form with confidence.

Follow the steps to fill out the CR 0100AP form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, indicate the reason for filing this application by selecting from the options: original application, change of ownership, or additional location. If applicable, provide your Colorado Account Number.

- In Section B, fill out the business information. Include the taxpayer name, social security number (SSN) if applying as an individual, or federal employer identification number (FEIN) for other types of businesses. Enter the trade name if applicable and provide proof of identification.

- Provide the principal address in Section B, including the city, state, county, and phone number. If the mailing address is different, make sure to fill out Section 4 accordingly.

- Section C requires you to specify the type of sales applicable to your business—wholesaler, retail sales, or charitable—and your anticipated filing frequency based on sales tax collections. Indicate the first day of sales if applicable.

- In Section D, select the type of withholding account needed—W-2, 1099, or Oil/Gas withholding. Estimate the annual wage withholding to determine the appropriate filing frequency.

- Fill out Section E regarding fees, ensuring you understand which fees apply based on the type of license being applied for. Indicate the appropriate amounts.

- In Section F, read and acknowledge the points of compliance that relate to ongoing responsibilities once your license is obtained.

- Finally, Section G requires a signature from the owner, partner, or corporate officer. Be sure to include the title and date of the signature.

- Once all sections are completed, users can save changes, download, print, or share the form as needed.

Complete your documents online today to streamline your business registration process.

Yes, Colorado is a mandatory withholding state, meaning employers are required to withhold state income tax from employees' wages. It is crucial to ensure that the correct amounts are withheld and reported using the CR 0100AP (06/10/20) form. The U.S. Legal Forms platform provides resources to help navigate this requirement effortlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.