Get Nm Trd Rpd-41301 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD RPD-41301 online

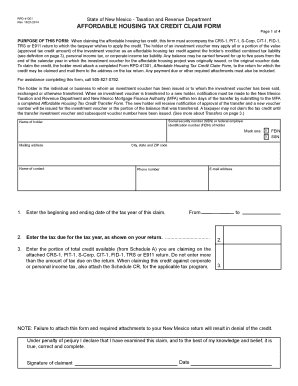

The NM TRD RPD-41301, also known as the Affordable Housing Tax Credit Claim Form, is essential for claiming tax credits associated with affordable housing investments in New Mexico. This guide provides a step-by-step approach to help users fill out the form accurately and efficiently, ensuring that all necessary information is provided.

Follow the steps to complete the NM TRD RPD-41301 form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the social security number (SSN) or federal employer identification number (FEIN) for the holder at the specified field on the form.

- Provide the name of the holder in the corresponding field to identify who is claiming the tax credit.

- Select the appropriate option by marking the appropriate checkbox provided on the form.

- Fill in the mailing address of the holder, including city, state, and ZIP code, to ensure correspondence is directed correctly.

- Provide the email address and phone number of the holder for further communications if needed.

- Enter the beginning and ending dates of the tax year for which the claim is being made.

- Input the total tax due for the tax year as indicated on the respective tax return.

- Indicate the portion of the total credit available you are claiming, ensuring it does not exceed the tax due. Attach Schedule A if necessary.

- Sign and date the form to declare the information true and complete under penalty of perjury.

- Upon completing the form, save your changes. You will have options to download, print, or share the form as needed.

Complete your NM TRD RPD-41301 online today to ensure you maximize your tax credit benefits.

Get form

To qualify for low-income housing in New Mexico, individuals or families must meet specific income criteria set by state guidelines. The process often involves submitting financial information and demonstrating a genuine need for assistance. Using resources such as NM TRD RPD-41301 can empower applicants to understand the requirements and streamline their search for suitable housing options.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.