Loading

Get Nm Trd Pit-1 Instructions 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD PIT-1 Instructions online

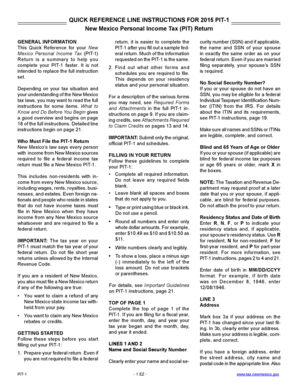

Completing your New Mexico Personal Income Tax (PIT-1) return can be straightforward with the right instructions. This guide provides step-by-step assistance to help you effectively fill out the PIT-1 form online, ensuring you understand each component and requirement.

Follow the steps to complete your PIT-1 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Take a moment to prepare your federal income tax return, as much of the information will be similar to what is required on the PIT-1.

- Refer to the full PIT-1 instructions if necessary, especially for understanding your residency status and what specific forms may be required.

- Start filling out the top section of page 1 with your personal information, ensuring you enter your name and Social Security Number (SSN) accurately.

- Indicate if you or your spouse are aged 65 or older or blind by marking the appropriate boxes.

- Provide your residency status using the specified code (R, N, F, or P) and enter your date of birth in the required format.

- Complete address information accurately, including any changes since your last filing.

- If applicable, provide information related to a deceased taxpayer or spouse in the specified lines.

- Fill out the exemptions for dependents, ensuring to follow federal guidelines.

- Mark your filing status and ensure that your categories are consistent with your federal return.

- Proceed to complete lines for income and deductions as described in the detailed instructions for the PIT-1.

- Check for any additional credits or deductions that you may be eligible for by reviewing the guidelines provided in the instructions.

- Finalize your form by reviewing all entries for accuracy, then save, download, print, or share the completed document as needed.

Complete your NM TRD PIT-1 Instructions online today to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Individuals typically obligated to file a tax return include those who earn income above the minimum threshold set by the state. This obligation applies to both residents and non-residents of New Mexico. The NM TRD PIT-1 Instructions provide comprehensive information to help you understand your responsibilities regarding tax filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.