Loading

Get Me 941p-me Instructions 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME 941P-ME Instructions online

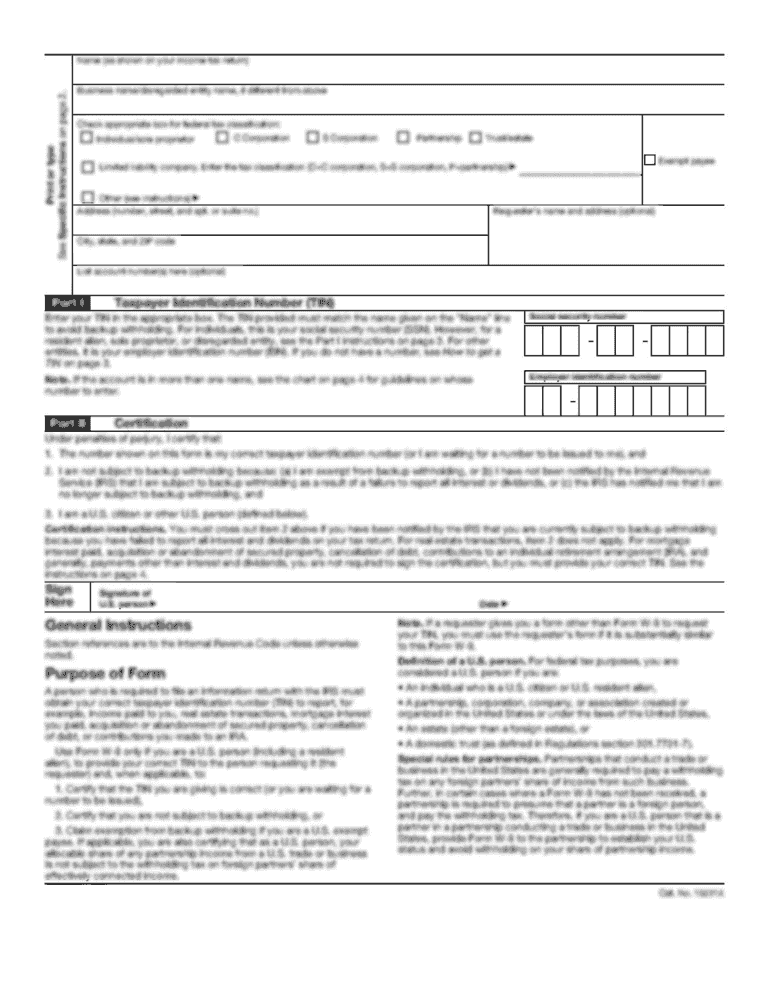

Filling out the ME 941P-ME form online can be a straightforward process when you have a clear understanding of each section and field. This guide provides a step-by-step approach to help you navigate the ME 941P-ME Instructions effectively.

Follow the steps to successfully complete the ME 941P-ME Instructions online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the entity information, including the name, address, and federal identification number.

- If you are filing an amended return, check the amended return box and complete all lines on page 1, noting any original amounts.

- Complete Line A if there are members of the entity that are exempt from withholding as compliant taxpayers or composite filers, and continue to fill out Schedule 3P.

- Line B should reflect the total number of members who were nonresidents of Maine at any point during the reporting period.

- Enter the amount of withholding from Schedule 2P on Line 1, ensuring this matches the total reported in Box 1 of Form 1099ME.

- On Line 2, indicate the total of estimated withholding payments made for the calendar year, excluding any lower-tier amounts.

- Complete Line 3a if there is withholding due, indicating this amount which must be paid electronically if your total Maine tax liability is $10,000 or more.

- If applicable, check the box below Line 3b if you have an ownership interest in or received income reported on Schedule K-1 from another pass-through entity.

- Fill out Schedule 1P for entity apportionment. This includes entering Maine and total U.S. sales data.

- Complete Schedule 2P, providing details for each nonresident member, including their name, identification number, and distributive share percentage.

- Finalize the form by reviewing all entered information for accuracy, and choose to save changes, download, print, or share the form.

Complete your ME 941P-ME Instructions online today to ensure your tax filing is timely and accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You need to mail your Maine tax return to the designated address outlined in the ME 941P-ME Instructions. Various factors, such as the type of return and your payment method, will influence the correct address. Always verify this information to ensure your tax documents arrive without a hitch. If you’re looking for further guidance, uslegalforms offers helpful resources to navigate the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.