Loading

Get Nm Trd Pit-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD PIT-1 online

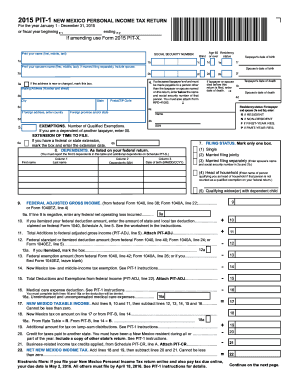

This guide provides step-by-step instructions on completing the New Mexico Personal Income Tax Return (PIT-1) online. By following these instructions, users can accurately fill out the form and ensure a successful submission while receiving any applicable refunds or credits.

Follow the steps to complete your NM TRD PIT-1 online.

- Click ‘Get Form’ button to access the NM TRD PIT-1 and open it in your chosen online editor.

- Enter your legal name in the designated field. Provide your first, middle, and last names as they appear on your identification documents.

- In the next section, input your Social Security Number (SSN) accurately to ensure proper identification and processing.

- Indicate your residency status by marking the appropriate option: Resident (R), Non-Resident (N), First-Year Resident (F), or Part-Year Resident (P).

- Complete the exemption section by noting the number of qualified exemptions you are claiming. If you are a dependent of another taxpayer, enter ‘00’.

- Input your federal adjusted gross income as derived from your federal tax return. Ensure accuracy by cross-referencing with your Form 1040.

- Calculate and enter the necessary deductions based on your situation, selecting between the standard deduction and itemized deductions as appropriate.

- List any credits you may be entitled to, such as credits for taxes paid to another state or business-related income tax credits.

- Review the form for completeness and accuracy before submitting. This includes checking all calculations and confirming that required documents and schedules are attached.

- Once all fields are completed and verified, you can save changes, download, print, or share the completed NM TRD PIT-1 form as needed.

Complete your NM TRD PIT-1 online today for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The tax rate in New Mexico varies according to income brackets, with rates ranging from 1.7% to 4.9% for individuals. Understanding these tax rates is essential for calculating your potential tax liability, especially when filling out your NM TRD PIT-1 form. Taxpayers should stay informed about potential changes in rates to ensure compliance and optimize their tax situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.