Loading

Get Vt Schedule K-1vt 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Schedule K-1VT online

Filling out the VT Schedule K-1VT is a crucial task for individuals involved with partnerships or corporations in Vermont. This guide will help you navigate the online process smoothly and accurately.

Follow the steps to complete the VT Schedule K-1VT online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

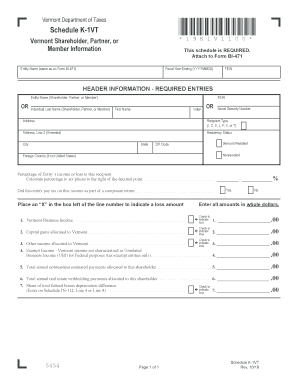

- Fill in the required header information. This includes the entity name (as it appears on Form BI-471), the fiscal year ending date in the format YYYYMMDD, and the Federal Employer Identification Number (FEIN).

- Complete the section for the shareholder, partner, or member. Enter their last name, first name, initial, and either their FEIN or Social Security Number.

- Provide the address information. Include the street address, city, state, ZIP code, and any international information if applicable. Indicate residency status by selecting whether they are a Vermont resident, nonresident, or from a foreign country.

- Calculate and enter the percentage of entity’s income or loss allocated to this recipient, rounded to six decimal places.

- Indicate whether the entity paid tax on this income as part of a composite return by selecting 'Yes' or 'No' with an 'X'.

- Input the amounts for each income type allocated to Vermont: Vermont business income, capital gains, other income, exempt income, estimated payments, real estate withholding payments, and any share of federal bonus depreciation difference. Each entry should be made in whole dollars.

- Once all fields are filled out correctly, conclude the process by saving your changes. You may also download, print, or share the form as needed.

Complete your VT Schedule K-1VT online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To calculate your taxable income, start with your total income, including wages, investments, and any income reported on forms like the VT Schedule K-1VT. Apply allowable deductions and adjustments as permitted by Vermont state guidelines. This process will give you a clearer picture of your taxable income and overall tax liability.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.