Get Vt Schedule In-113 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

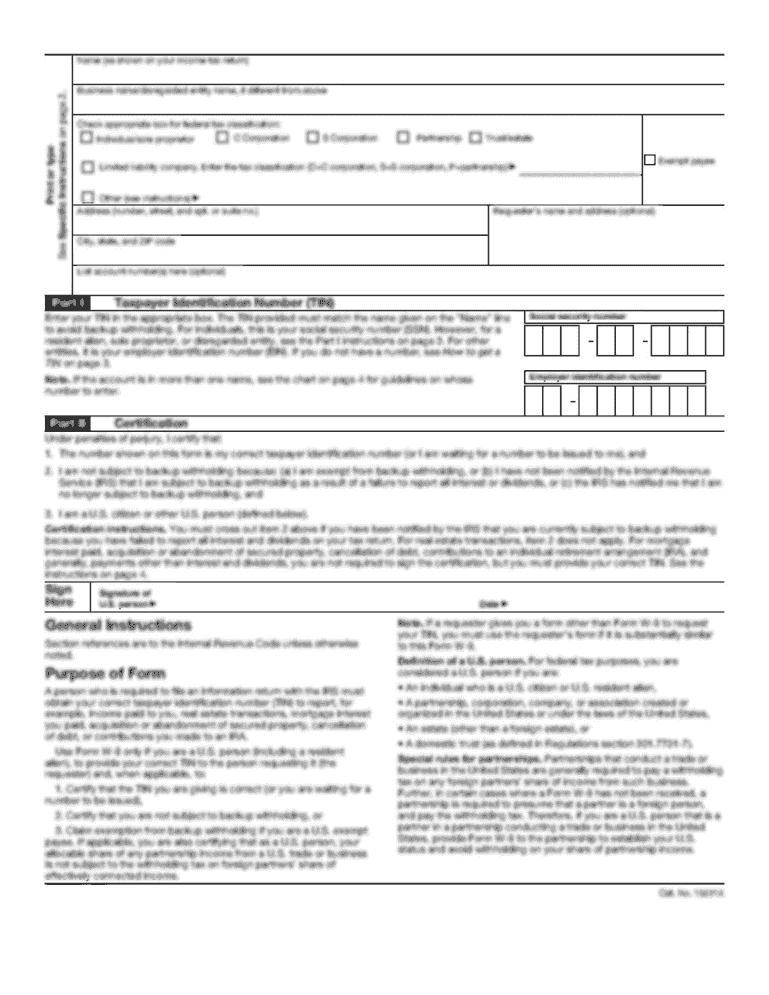

Tips on how to fill out, edit and sign VT Schedule IN-113 online

How to fill out and sign VT Schedule IN-113 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of troubling intricate legal and tax paperwork has concluded. With US Legal Forms, the process of filing legal documents is stress-free. The finest editor is already at your disposal, providing you with various beneficial tools for submitting a VT Schedule IN-113. These instructions, along with the editor, will guide you through the entire procedure.

We make filling out any VT Schedule IN-113 easier. Utilize it now!

- Click the orange Get Form button to begin editing and improving.

- Enable the Wizard mode in the upper toolbar to receive further advice.

- Fill in each editable section.

- Verify that the information you enter in VT Schedule IN-113 is current and precise.

- Add the date to the document using the Date feature.

- Press the Sign button and create an electronic signature. You have three options: typing, drawing, or capturing one.

- Ensure that every section is completed correctly.

- Click Done in the top right corner to export the document. There are several methods for obtaining the document: as an attachment in an email, by mail as a printed copy, or via instant download.

How to modify Get VT Schedule IN-113 2019: tailor forms online

Utilize the user-friendly nature of the multi-functional online editor while completing your Get VT Schedule IN-113 2019. Utilize the assortment of tools to quickly fill in the gaps and supply the requested information without delay.

Drafting documents can be time-consuming and expensive unless you have pre-prepared fillable templates to complete electronically. The simplest method to handle the Get VT Schedule IN-113 2019 is to utilize our expert and multi-functional online editing tools. We provide you with all the necessary resources for swift form completion and allow you to make amendments to your documents, tailoring them to any specifications. Additionally, you can annotate the modifications and leave notes for other participants.

Here’s what you can accomplish with your Get VT Schedule IN-113 2019 in our editor:

Handling the Get VT Schedule IN-113 2019 in our efficient online editor is the quickest and most efficient way to manage, submit, and share your documents as you require from anywhere. The tool functions from the cloud so you can access it from any location on any device with internet connectivity. All forms you generate or fill out are securely stored in the cloud, ensuring you can always access them when needed and rest assured that they won’t be lost. Stop wasting time on manual document filling and eliminate paper usage; accomplish it all online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize vital details with a preferred color or underline them.

- Obscure sensitive information with the Blackout tool or simply delete it.

- Upload images to illustrate your Get VT Schedule IN-113 2019.

- Replace the original text with content that meets your needs.

- Add comments or sticky notes to discuss with others about the modifications.

- Remove unnecessary fillable fields and assign them to specific recipients.

- Secure the template with watermarks, place dates, and bates numbers.

- Distribute the document in various formats and save it on your device or the cloud once you complete the adjustments.

Get form

Vermont's property tax rates are high primarily due to the need to fund local services like education and public infrastructure. The state's reliance on property taxes means that homeowners often face significant tax bills. Being informed about property taxes and utilizing documents like the VT Schedule IN-113 can help you manage your expenses effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.