Loading

Get Nj Dot Git/rep-3 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT GIT/REP-3 online

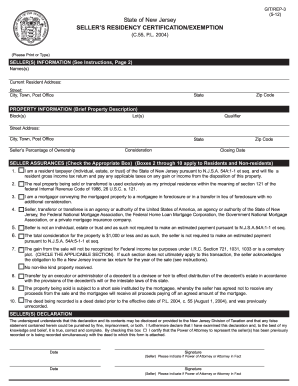

The NJ DoT GIT/REP-3 is a crucial form for individuals and entities selling or transferring property in New Jersey. This guide provides a clear step-by-step approach to help you complete the form correctly and efficiently online.

Follow the steps to successfully fill out the NJ DoT GIT/REP-3.

- Press the ‘Get Form’ button to access the document and open it for editing.

- Enter the names of all sellers in the designated 'Names(s)' field. If there is more than one seller, each must complete a separate form, except for partners who file jointly.

- Fill in the current resident address, ensuring that you enter the primary residence of the seller(s), not the address of the property being sold.

- Provide property information including block and lot numbers, as well as a brief property description. This information should be aligned with what is stated on the property deed.

- Specify the seller’s percentage of ownership. If there are multiple sellers, indicate the ownership share of each seller.

- State the consideration for the property, which refers to the total amount involved in the sale, including any monetary value of items exchanged.

- Indicate the closing date of the transaction, ensuring it is accurate and reflects the official date of sale.

- Review the seller assurances section and select the appropriate box that applies to the seller's situation. Be cautious as some boxes apply to both residents and non-residents.

- Sign and date the form. If a representative is signing on behalf of the seller(s), ensure that the Power of Attorney documentation is included as required.

- Once all fields are completed, save the changes to the document. You may also download, print, or share the completed form as needed before submitting it.

Complete your NJ DoT GIT/REP-3 online today to ensure a smooth property transaction process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The New Jersey real estate exemption refers to specific situations where certain transactions may not incur GIT taxes. For example, transactions involving transfers between spouses may qualify. Understanding this exemption can simplify your obligations under the NJ DoT GIT/REP-3, making the process more efficient.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.