Loading

Get Uk Sa103f 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK SA103F online

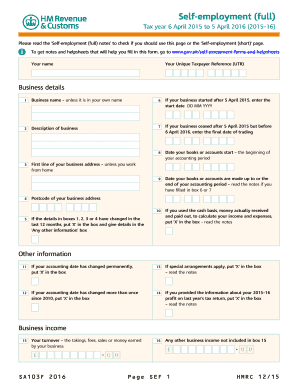

Filling out the UK SA103F form online can seem daunting, but this guide will support you through each section. With detailed instructions tailored to meet your needs, you can complete the form efficiently and accurately.

Follow the steps to complete the online form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and Unique Taxpayer Reference (UTR) in the designated fields.

- Fill in the business details, including the business name, description of the business, and the first line of the business address, unless it is your home.

- Complete the accounting period dates by entering the start date and the made-up-to date of your accounts.

- If applicable, indicate if you used the cash basis for calculating your income and expenses.

- Fill in your business income by entering your turnover figure in the appropriate box.

- Provide total expenses and detail any disallowable expenses as specified in the form.

- Calculate your net profit or loss based on the income and expenses entered.

- Enter any additional information relevant to your business and complete the tax allowances section if applicable.

- Review all information entered for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your UK SA103F form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Claiming a UK tax refund from overseas involves completing the necessary forms and providing required documentation. You can initiate this process through the HMRC website or, if needed, engage a tax professional who specializes in international issues. Remember to include details about your UK SA103F form to support your refund claim.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.