Get Uk Iht403 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK IHT403 online

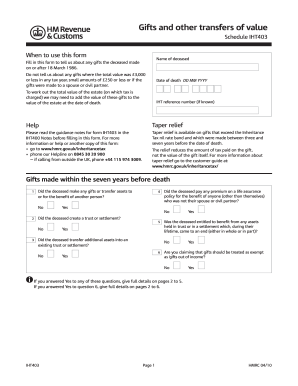

The UK IHT403 form is an essential document for reporting gifts made by a deceased individual and determining any applicable inheritance tax. This guide provides a clear and supportive approach to help users fill out the form online, ensuring all necessary information is accurately captured.

Follow the steps to complete your IHT403 online

- Press the ‘Get Form’ button to obtain the IHT403 form and open it in your editor.

- Begin by entering the name of the deceased and the date of death. Ensure the date is formatted as DD MM YYYY.

- Provide the IHT reference number if it is known. This number can help in processing the form.

- Answer the initial questions about gifts made by the deceased within seven years before their death. Indicate 'Yes' or 'No' for each inquiry regarding gifts or transfers.

- For any gifts made within the relevant time frame, fill in the details on pages 2 to 5 about the date of the gift, recipient, and description of the asset.

- Continue to complete any sections regarding gifts with reservation of benefit, pre-owned assets, and earlier transfers as applicable, providing the required financial information.

- If applicable, complete the section for gifts made as part of normal expenditure out of income. Include the deceased's income and expenditure details for each relevant year.

- Review all the information entered to ensure it is accurate and complete. Double-check figures against your records.

- At the end of the process, you can choose to save changes, download, print, or share the completed form.

Now that you have the steps, complete your IHT403 document online for a smooth submission process.

Get form

Filling out a customs form for the UK requires accurate information regarding your items, including their value and purpose. Each form typically necessitates the inclusion of personal details and a description of what you are bringing into the country. If you seek clarity on customs forms and how they relate to your UK IHT403 liabilities, consulting with US Legal Forms offers valuable resources.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.