Loading

Get Nj Cbt-100s 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBT-100S online

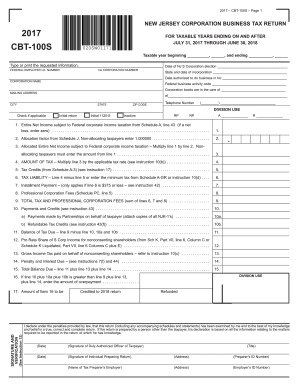

The NJ CBT-100S is an important form for New Jersey S corporations, detailing shareholders' shares of income, deductions, and more. This guide provides a comprehensive overview of how to correctly fill out the form online, ensuring compliance and accuracy.

Follow the steps to complete the NJ CBT-100S online.

- Click ‘Get Form’ button to open the NJ CBT-100S document in your preferred online document management editor.

- Begin with Part V, where you will summarize resident shareholders' pro rata shares. Enter each shareholder's name in column (A) and their Social Security Number in column (B). Input the respective pro rata share income/loss in column (C) and any gain/loss on disposition of assets in column (D). Finally, record distributions in column (E). Ensure that you calculate and enter the total at the bottom of this section.

- Proceed to Part VI for consenting non-resident shareholders' pro rata shares. Repeat the entries as described in step 2, but ensure to differentiate between income allocated to New Jersey and not allocated. Clearly enter these values in the specified columns. Calculate the distributions as in Part V.

- In Part VII, summarize non-consenting shareholders' pro rata shares by entering each shareholder's name and Social Security Number as before. Input their income/loss and note the allocation distances by filling in columns (C) through (H) appropriately based on the provided guidelines.

- Once all sections are accurately completed, review your entries for clarity and correctness. You can then save changes, download, print, or share the completed form according to your needs.

Start filling out the NJ CBT-100S online to ensure your S corporation's details are accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The income limit for the NJ anchor program can vary based on your filing status and the specific program year. Generally, lower-income households may qualify for greater benefits. For the most current information, review the guidelines published by the New Jersey Division of Taxation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.