Loading

Get Mt Pr-1 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT PR-1 online

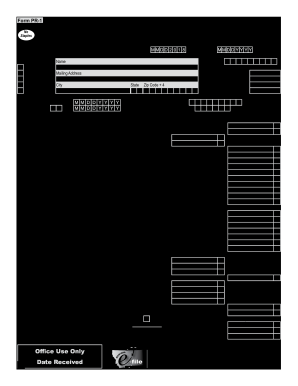

The MT PR-1 form is essential for partnerships operating in Montana, enabling them to report their income and tax obligations accurately. This guide provides clear, step-by-step instructions to help users navigate the form with ease.

Follow the steps to successfully complete the MT PR-1 online.

- Press the ‘Get Form’ button to acquire the MT PR-1 form and open it in your online editor.

- Indicate the tax year at the top of the form by entering the beginning and ending dates. Choose the appropriate box to categorize your return as initial, final, amended, or for refund.

- Fill in the partnership's name and Federal Employer Identification Number (FEIN) in the designated fields. Input the number of included Schedules K-1 and partner information, including resident, nonresident, and other types of partners.

- Provide the mailing address, city, state, and zip code for your partnership. Also, indicate the date registered in Montana and the state it was formed in.

- Complete the sections on the Partners’ Distributive Share of Income Items by entering the respective income or loss amounts as reported on federal Form 1065.

- Continue by detailing the Deductions and Montana Additions, ensuring all additions and deductions are accurately recorded according to the instructions.

- Calculate and report the Montana source income, ensuring to multiply by the appropriate factors as defined in the form's instructions for apportionment.

- Proceed to the Calculation of Amount Owed or Refund section and fill out your total tax obligations, withholding payments, and any penalties or interest.

- In the Direct Deposit section, provide your bank routing number and account number if you opt for direct deposit of any potential refund.

- Finally, review the declaration statement before signing. Ensure all prepared names and signatures are completed accordingly. Save your changes, download the completed form, and print it if necessary.

Complete the MT PR-1 online today to ensure timely and accurate tax reporting for your partnership.

The PTE rate, or pass-through entity tax rate, in Montana is designed for businesses such as partnerships and S corporations. As of the latest updates, this rate offers various benefits for these types of entities. Understanding the PTE rate can help you optimize your tax strategy effectively. If you need to navigate these regulations, US Legal Forms provides useful resources to streamline your MT PR-1 filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.