Loading

Get Au Form 1023 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU Form 1023 online

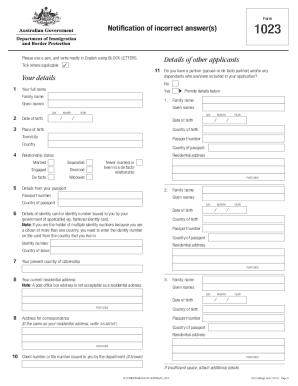

Filling out the AU Form 1023 online is a crucial step for informing the Department of Immigration and Border Protection about any incorrect information you may have previously provided. This guide provides clear and comprehensive steps to assist you in completing the form accurately.

Follow the steps to complete AU Form 1023 online.

- Press the ‘Get Form’ button to access the form and open it in the appropriate editor.

- Enter your personal details. This includes your full name (family name and given names), date of birth, and place of birth. Ensure that all the information is accurate and matches your identification documents.

- In the details of incorrect information section, indicate where you previously provided incorrect information. Select whether this was related to a visa application, passenger card, or another relevant form.

- List the incorrect information next to the correct details you need to provide. Be clear and precise to avoid further confusion.

- Complete the declaration at the end of the form. Ensure that you understand the implications of providing incorrect information and sign the form.

- Review all the information entered in the form. Make any necessary corrections before finalizing your submission.

- Once verified, you can save changes, download, print, or share the completed form as needed.

Complete your AU Form 1023 online to ensure your information is accurate and up to date.

The processing time for AU Form 1023 generally varies but can take several months. According to IRS guidelines, you should expect about 3 to 6 months for your application to be processed. Factors such as the volume of applications can affect this timeline. Therefore, it is advisable to plan accordingly and submit your form well in advance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.