Loading

Get Mt Dor Mw-3 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR MW-3 online

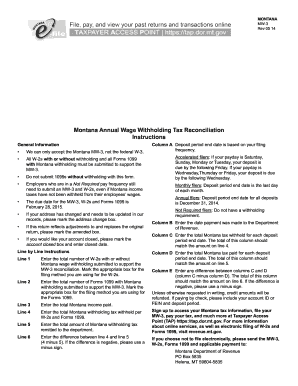

The Montana Annual Wage Withholding Tax Reconciliation (MW-3) is an essential form for employers to report wages and withholding taxes. This guide offers clear, step-by-step instructions to assist users in completing the form effectively online.

Follow the steps to accurately complete the MW-3 form.

- Press the ‘Get Form’ button to access the MW-3 form in the online editor.

- Fill in the employer's name, address, FEIN, and account ID at the top of the form.

- Indicate the pay frequency by checking the appropriate box provided.

- Line 1: Enter the total number of W-2 forms submitted for reconciliation, and select the filing method option.

- Line 2: Enter the total number of Forms 1099 with Montana withholding submitted, and choose the filing method.

- Line 3: Enter the total Montana income paid, as shown on your W-2s and Forms 1099.

- Line 4: Report the total amount of Montana withholding tax that was withheld from the W-2s and Forms 1099.

- Line 5: Enter the total amount of Montana withholding tax that has been paid to the Department of Revenue.

- Line 6: Calculate the difference between Line 4 and Line 5. If the result is negative, include a minus sign.

- Complete the columns labeled A to E by following the instructions closely: report the deposit period end dates, payment dates, withholding amounts, paid amounts, and any differences.

- If applicable, mark the boxes for address changes, amendments, or account closure.

- Lastly, review all entered information, save the changes, and choose to download, print, or share the completed MW-3 form.

Complete your MW-3 form online today to ensure timely and accurate filing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can reach the Montana Department of Revenue at their main phone number, which is available on their official site. They provide assistance for various inquiries, including filing queries related to the MT DoR MW-3. If you have specific questions or need help, don't hesitate to reach out. Being informed helps streamline your dealings with state tax forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.