Loading

Get Mt Dor Apls101f 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR APLS101F online

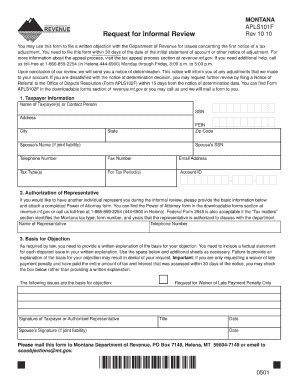

Completing the MT DoR APLS101F form is an essential step for filing a written objection regarding a tax adjustment with the Montana Department of Revenue. This guide will walk you through the process, providing clear instructions for each section to ensure you successfully file your objection online.

Follow the steps to accurately complete the MT DoR APLS101F form online.

- Press the ‘Get Form’ button to access the MT DoR APLS101F form and open it in your preferred online editor.

- In the 'Taxpayer Information' section, enter the name of the taxpayer(s) or the contact person. Fill in their SSN, address, city, state, zip code, and telephone number. If applicable, include the spouse's name and SSN.

- Provide the Tax Type(s), Email Address, Account ID, and the time period for which you are disputing the tax adjustment.

- For the 'Authorization of Representative' section, if you wish to appoint someone to represent you, enter their name and telephone number. Ensure you attach a completed Power of Attorney form, which can be found in the downloadable forms section.

- In the 'Basis for Objection' section, clearly articulate your reasons for disputing the tax adjustment. Detail each disputed issue with factual statements in the provided space or attach additional sheets if necessary.

- If you are only requesting a waiver of late payment penalty, you may check the designated box instead of providing a detailed explanation.

- At the bottom of the form, ensure that the taxpayer or authorized representative signs and dates the form. If there is a joint liability, include the spouse's signature and date.

- Finally, review all information for accuracy, then save changes, download, print, or share the completed form as needed. Mail it to the Montana Department of Revenue or email it to the specified address.

Complete your documents online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Rebate income often is not taxable, but this can depend on various factors including state laws. For instance, rebates received in Montana may not influence your tax status as long as you follow the relevant guidelines like those in the MT DoR APLS101F. Always consider reaching out to a tax professional for precise information related to your situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.