Loading

Get Ca Ftb 3533 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3533 online

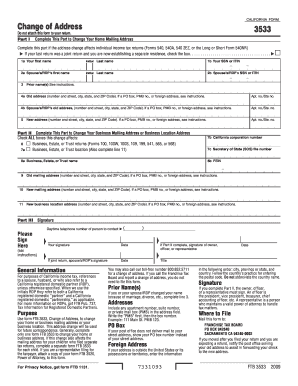

The CA FTB 3533 form is used to change your home or business mailing address with the California Franchise Tax Board. This guide offers clear and concise instructions on how to successfully fill out the form online.

Follow the steps to complete the form online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Part I, complete the section to change your home mailing address. Fill in your first name, middle initial, and last name, followed by your Social Security Number or Individual Taxpayer Identification Number (ITIN). If applicable, include your spouse's or registered domestic partner's (RDP's) name and their SSN or ITIN.

- Enter any prior names under the 'Prior name(s)' section if applicable.

- Fill in your old address in section 4a and, if relevant, your spouse's or RDP's old address in section 4b. Ensure you include the apartment or suite number if applicable.

- Provide your new address in section 5, ensuring accuracy in the number, street, city, state, and ZIP Code. Again, if applicable, include the apartment or suite number.

- Move to Part II to change your business mailing address or business location. Check all the applicable boxes affecting the change, including business types.

- In this part, provide the business name, California corporation number, Secretary of State file number, and Federal Employer Identification Number (FEIN) as required.

- Next, enter the old mailing address in section 9 and the new mailing address in section 10. If applicable, also fill out the new business location address in section 11.

- In Part III, ensure all signatories sign and date the form. If applicable, include the daytime telephone number of the contact person for follow-up.

- Once all information is accurately filled in, save your changes, and then download, print, or share the completed form as needed.

Take action and complete your CA FTB 3533 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When sending forms or correspondence to the California Franchise Tax Board, you should refer to the specific mailing address outlined for the form you are submitting. For the CA FTB 3533, it is essential to follow the instructions provided to ensure timely processing of your request. Platforms like US Legal Forms can assist in locating the correct addresses and guidelines for your submission.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.