Get In Dor Np-20 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR NP-20 online

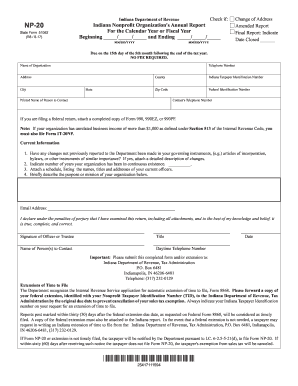

The Indiana Nonprofit Organization's Annual Report, also known as Form NP-20, is essential for nonprofit organizations in Indiana to report their activities for the year. This guide will provide a clear, step-by-step approach to help you complete the form online accurately and efficiently.

Follow the steps to complete the IN DoR NP-20 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the name of your organization in the designated field.

- Provide your organization's telephone number, followed by the complete address including city, state, county, and zip code.

- Input your Indiana Taxpayer Identification Number and Federal Identification Number in the respective fields.

- Fill in the printed name of the person to contact, their telephone number, and email address.

- If you are required to file a federal return, make sure to attach a completed copy of Form 990, 990EZ, or 990PF.

- Answer the current information questions: indicate whether any changes have been made to your governing instruments and provide a description if applicable.

- Indicate the number of years your organization has been in operation.

- Attach a schedule listing the names, titles, and addresses of your current officers.

- Briefly describe the purpose or mission of your organization in the provided space.

- The designated officer or trustee must sign and date the form, confirming its accuracy.

- Save your changes, and once completed, you may download, print, or share the finalized NP-20 form.

Complete your Indiana Nonprofit Organization's Annual Report online today!

Get form

In Indiana, any non-profit organization that is seeking tax-exempt status must file the NP-20 form with the Indiana Department of Revenue. This includes organizations involved in charitable, religious, or educational activities. Filing the NP-20 is essential to maintain compliance and benefit from tax exemptions. If you're uncertain about how to complete the NP-20, US Legal Forms can offer helpful support and resources.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.