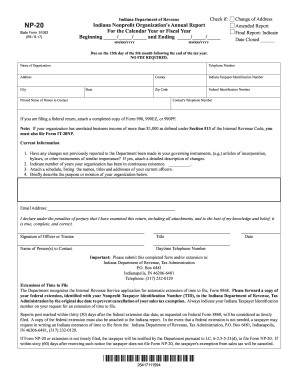

Get In Dor Np-20 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IN DoR NP-20 online

How to fill out and sign IN DoR NP-20 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and delivering all the essential tax documentation, including IN DoR NP-20, is the exclusive responsibility of a US citizen. US Legal Forms enhances your tax filing experience by making it clearer and more accurate. You can access any legal forms you need and fill them out online.

How to complete IN DoR NP-20 online:

Safeguard your IN DoR NP-20 diligently. Ensure that all your pertinent documents and information are in order while bearing in mind the deadlines and tax regulations imposed by the IRS. Make it simple with US Legal Forms!

- Obtain IN DoR NP-20 through your web browser on your device.

- Access the fillable PDF file with a single click.

- Begin filling out the template box by box, adhering to the guidance of the advanced PDF editor's interface.

- Carefully enter the text and numerical data.

- Select the Date box to automatically set the current date or adjust it manually.

- Utilize the Signature Wizard to create your custom electronic signature and sign in moments.

- Consult the IRS guidelines if you have any uncertainties.

- Press Done to save the modifications.

- Continue to print the document, download it, or send it via email, SMS, Fax, or USPS without leaving your browser.

How to Alter Get IN DoR NP-20 2013: Personalize Forms Online

Locate the appropriate Get IN DoR NP-20 2013 template and modify it immediately.

Enhance your documentation with an intelligent document modification solution for online forms.

Your everyday operations with documents and forms can be more efficient when you have all necessary tools in one location. For example, you can find, access, and change Get IN DoR NP-20 2013 within a single browser tab.

If you require a specific Get IN DoR NP-20 2013, you can quickly locate it using the intelligent search engine and gain instant access. There’s no need to download it or seek a third-party editor to alter it and insert your details. All the tools for productive work come together in a single bundled solution.

Make additional custom modifications with the available tools.

- This editing solution allows you to personalize, complete, and sign your Get IN DoR NP-20 2013 form directly on the spot.

- After identifying a suitable template, click on it to enter the editing mode.

- Once the form is open in the editor, all essential tools are at your disposal.

- You can easily fill in the designated areas and remove them if needed with the assistance of a straightforward yet versatile toolbar.

- Implement all changes right away, and sign the form without leaving the tab by simply clicking the signature field.

Get form

Qualifying for tax exemption in Indiana generally means your organization must serve a charitable, educational, or similar purpose. Each category has specific criteria that must be met, and the completion of the IN DoR NP-20 can significantly help in documenting this qualification. You should consult with the Indiana Department of Revenue to ensure you follow all necessary steps for proper classification.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.