Loading

Get Mo Form E-6 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-6 online

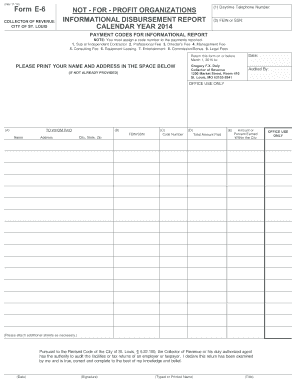

The MO Form E-6 is a vital document for not-for-profit organizations in St. Louis, designed to report payments made to various service providers. This guide offers clear, step-by-step instructions for completing the form online with ease.

Follow the steps to successfully complete the MO Form E-6 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Provide your daytime telephone number in the first box. This should be a number where you can be contacted during standard business hours (8:00 a.m. to 5:00 p.m. CST).

- In the second box, enter either your Federal Employer Identification Number (FEIN) or Social Security Number (SSN). This identifier is essential for processing your report.

- In column A, fill in the name and address of each person or organization that has received payments. Ensure that this information is clear and complete to avoid issues with processing.

- In column B, input the corresponding FEIN or SSN for each payee listed in column A. This step is vital for accurate record-keeping.

- In column C, assign the appropriate code number that reflects the type of payment made. Refer to the payment codes section for guidance.

- In column D, indicate the total amount paid to each payee. Make sure your calculations are accurate to ensure compliance.

- In column E, specify the amount or percentage of work that was performed within the City of St. Louis.

- If applicable, attach copies of Forms 1099-MISC that you have issued, ensuring each document notes the code number and applicable amount for the City.

- Date the form and provide your signature along with your typed or printed name and title, as required in the designated areas.

- Review the completed form to ensure it is legible and has been filled out correctly. Only complete and legible returns will be processed.

- Submit the finalized form by mail to Gregory F.X. Daly, Collector of Revenue, at the specified address. It is important to return this form by the deadline of March 1, 2015.

Complete the MO Form E-6 online today for timely processing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain a tax extension form from the Missouri Department of Revenue's website or through your tax preparation software. Many platforms, such as uslegalforms, offer convenient access to necessary forms, including those for tax extensions. Completing this form enables you to secure extra time for filing. Use MO Form E-6 as your guide to ensure all steps are correctly followed.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.