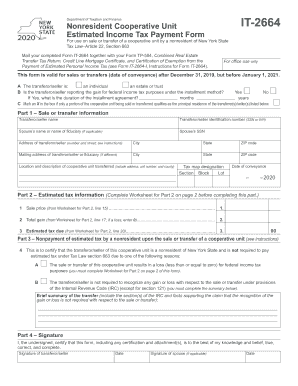

Get Ny Dtf It-2664 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-2664 online

How to fill out and sign NY DTF IT-2664 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own tax returns and, indeed, to complete forms electronically.

The US Legal Forms online platform facilitates the process of filing the NY DTF IT-2664 quickly and easily.

Ensure that you have accurately completed and submitted the NY DTF IT-2664 by the deadline. Consider any relevant terms. Providing incorrect information in your financial statements may lead to significant penalties and issues with your annual tax return. Make sure to use only professional templates from US Legal Forms!

- Access the PDF format in the editor.

- Refer to the specified fillable sections. This is where you will enter your details.

- Select the option if you see the checkboxes.

- Explore the Text tool along with other advanced options to manually adjust the NY DTF IT-2664.

- Verify all information before you proceed to sign.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Certify your document electronically and indicate the date.

- Click Done to continue.

- Save or send the document to the recipient.

How to modify Get NY DTF IT-2664 2020: personalize forms online

Your swiftly adjustable and customizable Get NY DTF IT-2664 2020 template is readily accessible.

Do you delay preparing Get NY DTF IT-2664 2020 because you simply don't know where to start and how to proceed? We recognize your sentiments and have an excellent solution for you that has nothing to do with overcoming your procrastination!

Our online selection of ready-made templates allows you to browse and choose from thousands of fillable forms designed for a variety of applications and occasions. But acquiring the form is only the beginning. We provide you with all the essential features to complete, sign, and modify the document of your preference without leaving our site.

All you need to do is open the document in the editor. Review the wording of Get NY DTF IT-2664 2020 and confirm whether it meets your requirements. Begin adjusting the template using the annotation tools to give your form a more structured and tidy appearance.

In summary, along with Get NY DTF IT-2664 2020, you will receive:

Compliance with eSignature regulations governing the use of eSignatures in online transactions.

With our fully featured option, your completed forms will almost always be legally binding and completely encrypted. We ensure to protect your most sensitive information. Acquire all it takes to create a professional-looking Get NY DTF IT-2664 2020. Make a wise decision and explore our service now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and refine the existing text.

- If the document is meant for other users as well, you can add interactive fields and distribute them for others to complete.

- Once you finish modifying the template, you can obtain the file in any available format or select any sharing or delivery options.

- A comprehensive suite of editing and annotation tools.

- A built-in legally-binding eSignature capability.

- The ability to create forms from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for securing your documents.

- A wide range of delivery options for seamless sharing and dispatching of documents.

Get form

When responding to a state tax audit, it’s important to be organized and thorough. Keep all relevant records and correspondence handy, as you may be required to present documentation to substantiate your claims. Using the guidelines from the NY DTF IT-2664 can also help you understand the audit process and ensure you address all concerns effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.