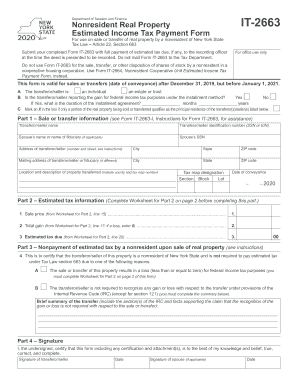

Get Ny Dtf It-2663 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-2663 online

How to fill out and sign NY DTF IT-2663 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans opt to handle their own tax filings and additionally, to fill out forms electronically.

The US Legal Forms online service streamlines the e-filing process for the NY DTF IT-2663, making it straightforward and user-friendly.

Ensure that you have accurately completed and submitted the NY DTF IT-2663 by the deadline. Review any relevant terms. Providing inaccurate information in your tax documents may result in serious penalties and complications with your annual tax return. Utilize only professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Refer to the highlighted fillable sections. This is where you will enter your details.

- Select the appropriate option when you encounter the checkboxes.

- Explore the Text tool and other advanced features to personalize the NY DTF IT-2663 manually.

- Double-check all information prior to signing.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your PDF form electronically and specify the exact date.

- Click Finish to proceed.

- Download or forward the document to the intended recipient.

How to modify Get NY DTF IT-2663 2020: personalize forms online

Place the appropriate document management features at your disposal. Complete Get NY DTF IT-2663 2020 with our reliable solution that merges editing and eSignature capabilities.

If you wish to finish and sign Get NY DTF IT-2663 2020 online without hassle, then our web-based option is the perfect solution. We offer an extensive template library of ready-to-use forms that you can modify and fill out online. Additionally, you do not need to print the form or utilize external options to make it fillable. All necessary tools will be at your fingertips once you access the document in the editor.

Let’s explore our online modification capabilities and their primary features. The editor has an intuitive interface, so it won't take much time to understand how to use it. We’ll highlight three main components that allow you to:

Aside from the features outlined above, you can protect your document with a password, add a watermark, convert the document to the desired format, and much more.

Our editor makes completing and validating the Get NY DTF IT-2663 2020 effortless. It offers you the capacity to handle nearly everything related to documents. Furthermore, we always make sure that your document modification experience is secure and adheres to the main regulatory standards. All these elements make using our tool even more enjoyable.

Obtain Get NY DTF IT-2663 2020, apply the necessary revisions and adjustments, and receive it in your preferred file format. Try it out today!

- Alter and annotate the template

- The top toolbar is equipped with tools that assist you in emphasizing and concealing text, minus images and image elements (lines, arrows, checkmarks, etc.), sign, initial, date the form, and more.

- Arrange your documents

- Utilize the toolbar on the left if you wish to rearrange the form or/and delete pages.

- Make them shareable

- If you want to render the document fillable for others and distribute it, you can employ the tools on the right and insert various fillable fields, signature and date, text box, etc.

Get form

Filling out a sales tax exemption certificate, like the ST-120, requires precise information about your business and the specific exemptions you qualify for. Begin by detailing your business name and address, then specify the items being purchased tax-exempt. Sign and date the form to complete it, and retain a copy for your records. Resources such as USLegalForms can guide you through the entire process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.