Get Canada Nr6 E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada NR6 E online

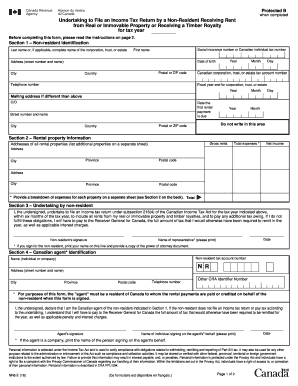

The Canada NR6 E form is a crucial document for non-residents who receive rental income from real or immovable property or timber royalties in Canada. This guide provides a step-by-step approach to completing the form online, ensuring accuracy and compliance with Canadian tax regulations.

Follow the steps to fill out the Canada NR6 E form with ease.

- Click ‘Get Form’ button to obtain the form and open it in your editing platform.

- In Section 1, provide your non-resident identification information, including your last name, first name, social insurance number or Canadian individual tax number, date of birth, address, and telephone number. If you are a corporation, trust, or estate, include your tax account number and fiscal year end.

- For Section 2, input details about each rental property. List the addresses of all rental properties and provide the gross income, total expenses, and net income for each property. Include a breakdown of expenses on a separate sheet.

- In Section 3, sign and date your undertaking, affirming your responsibility to file an income tax return within six months of the tax year. Ensure that if someone is signing on your behalf, they have the appropriate power of attorney documentation.

- Complete Section 4 by providing the information for your Canadian agent, who must be a resident of Canada. Include the agent’s name, address, non-resident tax account number, and signature.

- Once all sections are completed, review the form for accuracy. Users can then save changes, download, print, or share the form as required.

Complete your Canada NR6 E form online today for hassle-free tax compliance.

Filing your Canadian taxes from abroad can be straightforward if you have the right information and tools. You will typically use the same forms you would as a resident, including the T1 personal tax return. It is advisable to consult Canadian tax laws regarding residency status and deductions applicable to your situation. For further assistance, US Legal Forms offers valuable resources to help you navigate filing from outside Canada.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.