Loading

Get Ca Ftb 3525 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3525 online

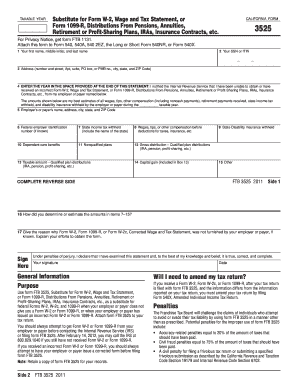

Filling out the CA FTB 3525 is essential for users who have not received or have received incorrect wage statements from their employers. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete your CA FTB 3525.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, middle initial, and last name in the designated field.

- Provide your Social Security Number (SSN) or Individual Tax Identification Number (ITIN) in the appropriate section.

- Fill in your address, including the number and street, apartment or suite number, post office box if applicable, city, state, and ZIP code.

- In the provided space, state the taxable year you are submitting this form for and describe your attempts to notify the Internal Revenue Service regarding your form W-2 or 1099-R.

- Complete the employer's or payer's name, address, city, state, and ZIP code.

- If known, enter the Federal Employer Identification Number (FEIN) for the employer or payer.

- Indicate the amount of state income tax withheld, specifying the name of the state.

- Report wages, tips, or other compensation before any deductions.

- Fill in any dependent care benefits received.

- Provide details regarding nonqualified plans, if applicable.

- Enter the gross distribution for qualified plan distributions such as IRA or pension.

- Indicate the taxable amount from the qualified plan distributions.

- If applicable, provide the capital gain included in your taxable amount.

- Detail any other relevant information as necessary.

- Explain how you determined or estimated the amounts listed in items 7 through 15.

- State the reasons why you did not receive Form W-2, 1099-R, or a corrected W-2c from your employer or payer.

- Sign and date the form, affirming that the information provided is true and complete to the best of your knowledge.

- Once completed, save changes, download, print, or share the form as needed.

Complete your CA FTB 3525 online today to ensure your tax reporting is accurate and timely.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out a sales tax exemption certificate, provide your business details and explain why you qualify for the exemption. Include your resale number or seller’s permit to establish credibility. You can find simplified forms and additional guidance through our US Legal Forms platform, which aligns with the CA FTB 3525.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.