Loading

Get Il Stax-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL STAX-1 online

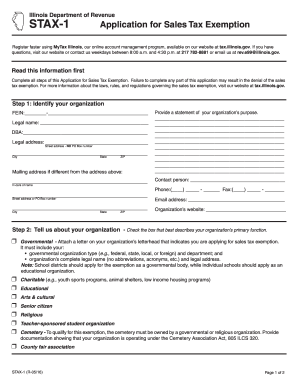

The IL STAX-1 is an essential document for applying for a sales tax exemption in Illinois. This guide provides step-by-step instructions to help users easily fill out the form online, ensuring smooth submission and compliance with state requirements.

Follow the steps to complete your application for sales tax exemption.

- Click ‘Get Form’ button to obtain the IL STAX-1. This will allow you to access the application in an editor format.

- Identify your organization by entering the following details: your Federal Employer Identification Number (FEIN), legal name, and Doing Business As (DBA) name if applicable. Provide your legal address, making sure to include the street address without using a PO Box number, followed by the city, state, and ZIP code.

- If your mailing address differs from the legal address, provide it here, including any in-care of name if needed. Enter the contact person's name, phone number, and fax number.

- Provide a clear statement outlining your organization’s purpose. This statement will support your application for the sales tax exemption.

- Select the box that best describes your organization’s primary function from the given options, such as governmental, charitable, educational, and others listed.

- For non-governmental organizations, ensure you include the required documentation when submitting your application, such as Articles of Incorporation, constitution, by-laws, detailed narrative, printed materials, IRS letter (if applicable), and an audited financial statement.

- Finally, sign the application under the penalties of perjury, affirming that the information provided is true, correct, and complete. Include your printed name and the date.

- After completing the application, mail it along with any required documentation to the Exemption Section of the Illinois Department of Revenue at the stated address.

Complete your application for sales tax exemption online today to ensure timely processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Illinois, the number of acres needed to claim a property as a farm for tax purposes is not strictly defined; however, it generally should be significant enough to support agricultural production. Many farmers successfully claim smaller parcels if they can demonstrate productive use. Consulting with IL STAX-1 can help clarify any specific requirements for your situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.