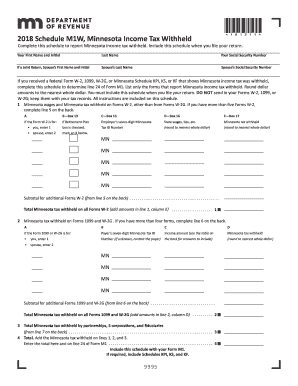

Get Mn M1w 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN M1W online

How to fill out and sign MN M1W online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans are inclined to handle their own income taxes and additionally, to complete forms digitally.

The US Legal Forms online platform simplifies the e-filing process for the MN M1W, making it straightforward and convenient.

Ensure that you have accurately completed and submitted the MN M1W on time. Be mindful of any relevant deadlines. Providing incorrect information on your tax documents may lead to serious penalties and complications with your annual tax return. Use only authorized templates from US Legal Forms!

- Open the PDF example in the editor.

- Look at the highlighted fillable fields, where you should input your information.

- Select the option if checkboxes are visible.

- Explore the Text icon along with other advanced features to edit the MN M1W manually.

- Review every detail before proceeding to sign.

- Create your unique eSignature utilizing a keyboard, camera, touchpad, mouse, or smartphone.

- Validate your online template and indicate the date.

- Click Done to proceed.

- Download or send the document to the intended recipient.

How to modify Get MN M1W 2018: personalize forms online

Experience a stress-free and paperless approach to working with Get MN M1W 2018. Utilize our reliable online platform and save a significant amount of time.

Creating every document, including Get MN M1W 2018, from the ground up requires too much effort, so having a proven system of pre-made form templates can greatly enhance your productivity.

However, utilizing them can be challenging, especially concerning files in PDF format. Thankfully, our extensive library features a built-in editor that enables you to effortlessly fill out and modify Get MN M1W 2018 without needing to leave our site, ensuring you don't waste time completing your paperwork. Here’s what you can accomplish with your document using our tools:

Whether you need to finish editable Get MN M1W 2018 or any other template available in our collection, you’re on the right track with our online document editor. It’s simple and secure and doesn’t require you to possess special skills.

Our web-based tool is built to handle practically everything you can imagine concerning document editing and processing. No longer rely on traditional methods for managing your documents. Opt for a professional solution to help you optimize your tasks and reduce your dependence on paper.

- Step 1. Locate the required form on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize professional editing tools that allow you to insert, delete, annotate, and highlight or conceal text.

- Step 4. Create and attach a legally-valid signature to your document by selecting the sign option from the top toolbar.

- Step 5. If the template layout doesn’t meet your needs, employ the tools on the right to delete, add more, and rearrange pages.

- Step 6. Include fillable fields so others can be invited to complete the template (if necessary).

- Step 7. Distribute or send the document, print it out, or select the format in which you would like to download the file.

Get form

Related links form

As of now, Minnesota does tax Social Security benefits, unlike some states that do not. However, there have been discussions about possible changes to this policy, so it's essential to stay informed. If you receive Social Security benefits, understanding your tax obligations can help you manage your finances effectively. For updated information and resources, platforms like uslegalforms can be very helpful.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.