Get Ne Dor Form 6 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

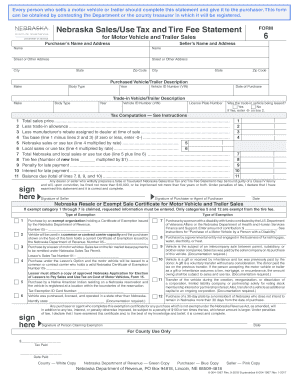

Tips on how to fill out, edit and sign NE DoR Form 6 online

How to fill out and sign NE DoR Form 6 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans lean towards managing their own taxes and, furthermore, completing forms digitally.

The US Legal Forms online service streamlines the process of filling out the NE DoR Form 6, making it simple and convenient.

Ensure that you have accurately completed and submitted the NE DoR Form 6 on time. Take into account any relevant deadlines. If you submit incorrect information in your financial documents, it may lead to substantial penalties and complications with your annual tax return. Use only reputable templates with US Legal Forms!

- Access the PDF template in the editor.

- Observe the highlighted fillable fields. Here you can enter your information.

- Select the option if you notice the checkboxes.

- Navigate to the Text icon and other advanced features to tailor the NE DoR Form 6 manually.

- Review all details prior to proceeding to sign.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your template electronically and insert the specific date.

- Click Done to proceed.

- Download or dispatch the document to the recipient.

How to Modify Get NE DoR Form 6 2018: Tailor Forms on the Web

Say farewell to an outdated paper-oriented method of completing Get NE DoR Form 6 2018. Have the form prepared and validated in a flash with our expert online editor.

Are you compelled to alter and complete Get NE DoR Form 6 2018? With a skilled editor like ours, you can do this in just minutes without the hassle of printing and scanning documents repeatedly.

We provide entirely customizable and user-friendly form templates that will serve as a foundation and assist you in filling out the necessary document template online.

All files, automatically, come with fillable fields you can complete once you access the template. However, if you wish to refine the existing content of the form or introduce new information, you can choose from various editing and annotation features. Emphasize, conceal, and comment on the document; insert checkmarks, lines, text boxes, images, notes, and remarks. Furthermore, you can effortlessly validate the template with a legally-binding signature. The finalized form can be shared with others, stored, imported to external applications, or converted into any suitable format.

Don't squander time completing your Get NE DoR Form 6 2018 the traditional way - with pen and paper. Utilize our feature-rich alternative instead. It offers a comprehensive suite of editing options, built-in eSignature functionalities, and user-friendliness. What sets it apart from similar choices is the team collaboration features - you can collaborate on documents with anyone, establish a well-structured document approval workflow from scratch, and much more. Test our online tool and gain the best value for your investment!

- Simple to establish and employ, even for those unfamiliar with completing documents online.

- Robust enough to accommodate diverse editing requirements and form categories.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible on various devices, making it convenient to finish the form from anywhere.

- Capable of producing forms based on pre-existing templates.

- Compatible with multiple file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Related links form

Form 20 in Nebraska is known as the Nebraska Sales Tax Exemption Certificate. It is used by organizations to make purchases without being charged sales tax. Understanding how to leverage the NE DoR Form 6 in conjunction with Form 20 will help you manage your tax responsibilities effectively, ensuring that your tax-exempt transactions are well documented.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.