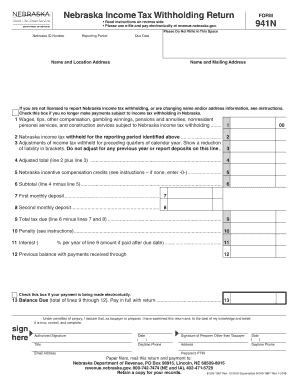

Get Ne Dor 941n 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NE DoR 941N online

How to fill out and sign NE DoR 941N online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans prefer to handle their own tax filings and, indeed, to complete forms in a digital format.

The US Legal Forms online platform simplifies the process of preparing the NE DoR 941N quickly and effortlessly.

Ensure that you have completed and submitted the NE DoR 941N accurately and on time. Be mindful of any relevant deadlines. Providing incorrect information on your financial statements can lead to significant penalties and complications with your yearly tax declaration. Utilize only official templates with US Legal Forms!

- Open the PDF template in the editor.

- Review the marked fillable areas. Here you can input your information.

- Select the option to choose when you encounter the checkboxes.

- Navigate to the Text icon along with other advanced tools to manually edit the NE DoR 941N.

- Verify all details before proceeding with your signature.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your online document electronically and indicate the date.

- Click on Done to continue.

- Store or forward the document to the recipient.

How to alter Get NE DoR 941N 2019: personalize documents online

Locate the appropriate Get NE DoR 941N 2019 template and adjust it instantly. Simplify your documentation with a clever document modification solution for online forms.

Your regular workflow with documentation and forms can be more productive when all you need is consolidated in one location. For example, you can search for, access, and adjust Get NE DoR 941N 2019 in a single browser tab. If you require a specific Get NE DoR 941N 2019, it is easy to locate it using the intelligent search engine and reach it immediately.

There’s no need to download it or seek a third-party editor to alter it and insert your details. All the tools for effective work come in one cohesive solution.

This editing solution lets you personalize, complete, and sign your Get NE DoR 941N 2019 form immediately. After finding an appropriate template, click on it to enter the editing mode. Once you load the form in the editor, all necessary tools are available at your disposal. You can conveniently fill in designated fields and delete them if necessary with a straightforward yet versatile toolbar.

Uncover new potentials in effective and straightforward documentation. Identify the Get NE DoR 941N 2019 you require within minutes and complete it in the same tab. Eliminate the clutter in your paperwork once and for all with the assistance of online forms.

- Implement all amendments immediately and sign the form without exiting the tab by simply clicking the signature field.

- Subsequently, you can send or print your document if needed.

- Make additional custom edits with the available tools.

- Annotate your document with the Sticky note tool by placing a note at any location within the document.

- Incorporate required visual components, if necessary, with the Circle, Check, or Cross tools.

Get form

In Nebraska, the payroll tax primarily refers to state income tax withheld, which is based on an employee’s income level. Additionally, employers may also be responsible for contributing to unemployment taxes. Utilizing the NE DoR 941N can help ensure that payroll taxes are calculated correctly and submitted on time.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.