Get Mn Dor St3 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR ST3 online

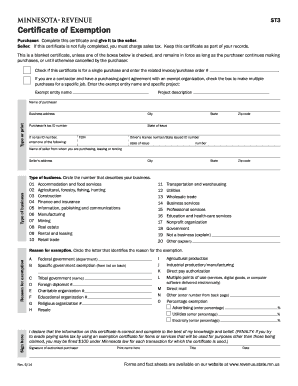

Completing the Minnesota Department of Revenue ST3 Certificate of Exemption online is a straightforward process. This guide will provide you with a clear, step-by-step approach to ensure accurate completion of the form, enabling you to claim your exemption effectively.

Follow the steps to complete the MN DoR ST3 online.

- Click the ‘Get Form’ button to access the ST3 Certificate of Exemption in an online format.

- Begin by filling out the purchaser's information. This includes the name, business address, city, state, and zip code. If available, include the purchaser’s tax ID number; if not, provide the FEIN or driver's license number.

- Next, supply the seller’s information by entering the name, type of business, address, city, state, and zip code. Be sure to specify the type of business by circling the corresponding number.

- Indicate the purpose of the exemption by selecting the appropriate reason. Circle the letter that correlates with the exemption reason from the options provided.

- If applicable, check the box for a single purchase or if you are a contractor making multiple purchases for a specific project. Enter the associated invoice or project details as required.

- Review all information for accuracy and completeness. Ensure that any required fields are filled, particularly the reason for exemption.

- Finally, sign the certificate, print your name, state your title, and enter the date signed. Once complete, you can save your changes, download the document, print it, or share it as necessary.

Complete your MN DoR ST3 form online today to ensure you receive the appropriate exemptions.

Get form

Related links form

The ST3 tax form in Minnesota is a document used to claim sales tax exemption for eligible purchases. When completing an MN DoR ST3 form, you certify that you qualify for a sales tax exemption based on specific criteria. This form is essential for businesses and individuals making exempt purchases to avoid overpaying sales tax. Proper use of the ST3 form ensures compliance with Minnesota tax laws.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.