Get Mn Dor Crp 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN DoR CRP online

How to fill out and sign MN DoR CRP online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans generally favor handling their own taxes and, additionally, filling out forms in digital format.

The US Legal Forms online platform facilitates the process of submitting the MN DoR CRP quickly and conveniently.

Ensure that you have accurately completed and submitted the MN DoR CRP on time. Consider any relevant deadlines. Providing false information in your financial documents may lead to severe penalties and complications with your annual tax return. Utilize only approved templates with US Legal Forms!

- Examine the PDF example in the editor.

- Observe the highlighted fillable sections. This is where your information should be entered.

- Select the option to choose if you notice the checkboxes.

- Explore the Text tool and other advanced features to customize the MN DoR CRP manually.

- Verify all the information before you proceed to sign.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your web-template electronically and indicate the specific date.

- Click on Done to continue.

- Save or send the document to the intended recipient.

How to Modify Get MN DoR CRP 2017: Personalize Forms Online

Place the appropriate document modification tools within your reach. Complete Get MN DoR CRP 2017 with our dependable solution that merges editing and electronic signature capabilities.

If you wish to complete and sign Get MN DoR CRP 2017 online without hassle, then our cloud-based solution is the right choice. We provide a rich template-driven collection of ready-to-use forms that you can alter and finalize online. Additionally, there’s no need to print the document or utilize external tools to make it fillable. All necessary functionalities will be accessible for your use immediately upon opening the document in the editor.

Let’s explore our online editing tools and their key features. The editor boasts an intuitive interface, ensuring that it won't take long to grasp its usage. We’ll review three core components that empower you to:

Beyond the features listed above, you can secure your document with a password, add a watermark, convert the file to the desired format, and much more.

Our editor simplifies the adjustment and certification of the Get MN DoR CRP 2017. It empowers you to accomplish nearly everything related to document handling. Furthermore, we consistently ensure that your experience in modifying documents is secure and adheres to the primary regulatory standards. All these aspects enhance your interaction with our tool.

Acquire Get MN DoR CRP 2017, implement the necessary adjustments and modifications, and download it in your chosen file format. Give it a try today!

- Alter and comment on the template

- The top toolbar includes features that assist you in emphasizing and concealing text, without images and photo elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

- Organize your documents

- Utilize the left toolbar if you wish to rearrange the document or/and eliminate pages.

- Prepare them for distribution

- Should you want to make the template fillable for others and share it, you can utilize the tools on the right to add various fillable fields, signatures and dates, text boxes, etc.

Get form

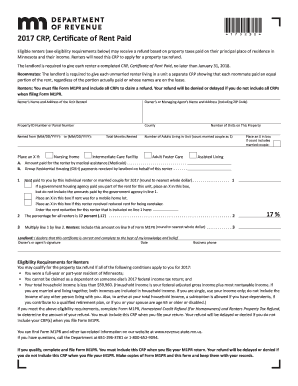

For renters, the MN DoR CRP offers financial assistance aimed at making housing more affordable. This program targets individuals facing economic hardships and helps them cover rental costs to prevent eviction. Eligible renters can apply for assistance, enhancing their ability to secure and maintain stable housing. Learn more about eligibility and application processes on the uslegalforms platform.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.