Loading

Get Ca Ftb 3500a 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3500A online

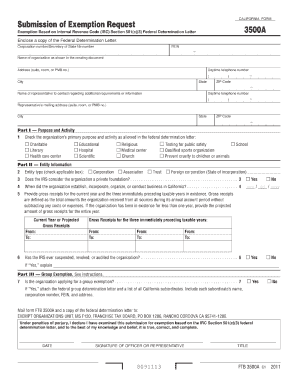

The CA FTB 3500A form is critical for organizations seeking tax-exempt status under specific sections of the Internal Revenue Code. This guide provides clear instructions to help users successfully complete the form online.

Follow the steps to accurately fill out the CA FTB 3500A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your California Corporation number or California Secretary of State file number and the Federal Employer Identification Number (FEIN) in the designated fields.

- In the 'Name of organization' field, provide the full name of your organization as it appears in the creating document.

- Complete the address section, including any suite, room, or Private Mail Box (PMB) number, followed by the city, state, and ZIP code.

- Fill in the daytime telephone number for your organization and ensure it is correct.

- Provide the name of the representative to contact regarding additional information or requirements and include their daytime telephone number.

- In Part I, select the appropriate entity type by checking the applicable box (Corporation, Association, Trust, or Foreign Corporation).

- Indicate whether the IRS considers the organization a private foundation and provide an explanation if applicable.

- Provide the date when the organization was established, incorporated, or began conducting business in California.

- List the gross receipts for the current year and the three immediately preceding taxable years as defined in the instructions.

- Answer whether the IRS has ever suspended, revoked, or audited the organization, providing an explanation if you answered 'Yes'.

- In Part II, indicate if the organization is applying for a group exemption and attach necessary documentation if applicable.

- Complete Part III by selecting the primary purpose and activity of the organization for the relevant exemption categories.

- Review the completed form for accuracy before final submission.

- Save changes, download, print, or share the completed form as necessary.

Start filling out your CA FTB 3500A form online now to secure your organization's tax-exempt status.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can file Form CA FTB 3500A directly with the California Franchise Tax Board. This form can be submitted online or via mail, depending on your preference. Ensure that you check the latest submission guidelines on the California FTB website to follow the correct procedure. If you require detailed help or templates, uslegalforms can assist you in organizing your required documents and filing correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.