Loading

Get Ma Schedule C 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule C online

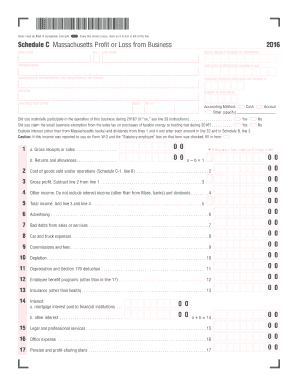

This guide provides clear instructions on how to complete the MA Schedule C form online. The Schedule C is essential for reporting profit or loss from business activities in Massachusetts, and understanding each section can simplify the process for users of all experience levels.

Follow the steps to fill out the MA Schedule C online:

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your first name, middle initial, and last name in the designated fields.

- Provide your Social Security number in the appropriate section.

- Input your business name and, if applicable, the Employer Identification Number.

- Indicate your main business or profession, including the specific products or services offered.

- Fill in the Principal Business Code as per the guidance in U.S. Schedule C.

- Enter your business address, including city, state, and ZIP code.

- Note the total number of employees you have.

- Select your accounting method by marking the appropriate oval: Cash or Accrual.

- If you materially participated in your business during the specified year, select 'Yes'; otherwise select 'No'.

- Indicate whether you claimed the small business exemption from sales tax for energy or heating fuel.

- Complete lines for Gross Receipts or Sales, Returns and Allowances, and determine Gross Profit by subtracting line 2 from line 1.

- Record any other income, and calculate Total Income by adding lines 3 and 4.

- List all expenses in their respective sections from Advertising to Other Expenses, making sure to accurately report figures.

- Calculate Total Expenses by adding the amounts from lines 6 through 26.

- Determine your tentative profit or loss by subtracting Total Expenses from Total Income.

- If applicable, fill in any expenses for business use of your home.

- Complete the Abandoned Building Renovation Deduction, if relevant.

- Calculate your Net Profit or Loss and enter it on the appropriate lines based on whether it is a profit or a loss.

- Review all entries for accuracy and completeness before saving your changes, downloading, printing, or sharing the form.

Complete your MA Schedule C online today to ensure accurate reporting of your business activities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Deductible meals on Schedule C pertain to business-related dining expenses incurred while conducting business activities. To qualify, these meals must be directly related to the business or associated with a business discussion. Understanding the specific guidelines for meal deductions can help you effectively report these expenses on your MA Schedule C.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.