Loading

Get Sc Dor Sc1065 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1065 online

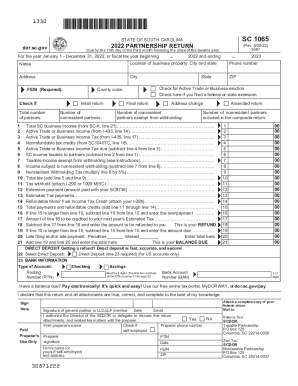

The SC DoR SC1065 is a crucial form for partnerships operating in South Carolina, allowing you to report income, deductions, and credits effectively. This guide provides a clear, step-by-step approach to help you complete the form online with ease, regardless of your legal background.

Follow the steps to successfully complete your SC1065 online.

- Use the ‘Get Form’ button to obtain the SC DoR SC1065 and open it in your editing interface.

- Fill in the partnership's name, location, and address in the designated sections at the top of the form. Include the federal employer identification number (FEIN) and county code.

- Indicate whether this is an initial return, final return, address change, or amended return by checking the appropriate boxes.

- Enter the total number of partners and the number of nonresident partners. If applicable, note the exempt nonresident partners.

- Complete the Schedule SC-K section by entering specified amounts from the federal schedule. Make South Carolina adjustments as instructed.

- Calculate the income for South Carolina tax purposes, including amounts subject to apportionment and allocate income as directed.

- Fill in the active trade or business income and tax due, ensuring correct calculations for tax credits and total tax.

- Identify the total payments and refundable credits. If there is an overpayment, indicate the amount to be credited towards next year or refunded.

- Sign the return, ensuring that the general partner or member's signature is included. Authorize discussions regarding the return with your preparer if desired.

- Lastly, save your changes, and consider your options to download, print, or share your completed SC1065.

Complete your SC DoR SC1065 online to ensure timely and accurate submission.

A pass-through entity is any entity other than an individual estate or trust that is recognized as a separate entity for federal income tax purposes and the owners of which report their distributive or pro rata shares of the entity's income, gains, losses, deductions, and credits on their own returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.