Loading

Get Or Form Or-18-wc 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form OR-18-WC online

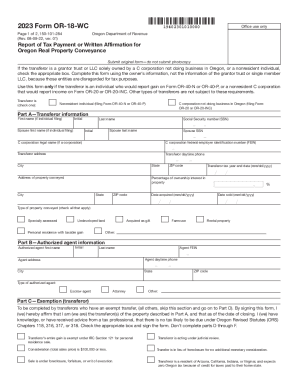

Filling out the OR Form OR-18-WC online is an essential step for reporting tax payments related to property conveyance in Oregon. This guide will provide you with clear, step-by-step instructions to ensure the form is completed accurately and efficiently.

Follow the steps to complete the OR Form OR-18-WC online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin with Part A—Transferor information. Fill in your first name, initial, last name, and Social Security number. If applicable, include your spouse's details as well.

- Provide the legal name and federal employer identification number (FEIN) of the C corporation if applicable. Enter the transferor's address, daytime phone number, and property address.

- Indicate the percentage of ownership interest in the property, type of property conveyed, and other relevant details such as the date of acquisition and date sold. Make sure to check all necessary boxes regarding the type of property.

- Move to Part B—Authorized agent information. Fill out the agent's first name, initial, last name, FEIN, address, and daytime phone number. Select the type of authorized agent.

- Proceed to Part C—Exemption (transferor). If applicable, check the appropriate box to affirm any exemptions and provide necessary signatures.

- In Part D—Calculation of gain, detail the purchase price, improvements, and related costs to calculate the adjusted basis of the property.

- Complete Part E—Calculation of tax payment if applicable, and ensure to determine the correct tax payment based on your taxable gain.

- In Part F—Payment information, document any payment details, and ensure signatures are provided in the designated areas.

- Once the form is completed, you can save changes, download, print, or share the form as necessary to submit to the Oregon Department of Revenue.

Start filling out the OR Form OR-18-WC online now to ensure your tax reporting is accurate and timely.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.