Loading

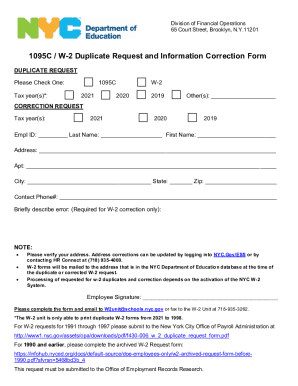

Get Ny 1095c/w-2 Duplicate Request And Information Correction Form 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY 1095C/W-2 Duplicate Request And Information Correction Form online

Filling out the NY 1095C/W-2 Duplicate Request And Information Correction Form online can seem daunting, but this guide will walk you through the process step-by-step. Whether you need a duplicate form or wish to correct existing information, this comprehensive overview will ensure that you complete the form accurately.

Follow the steps to complete your form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Indicate whether you are requesting a duplicate form or a correction by selecting the appropriate checkbox. You will see options for 1095C or W-2 in the 'DUPLICATE REQUEST' section.

- Select the tax year for which you are making the request by checking the relevant box for 2021, 2020, 2019, or entering another year in the designated space under 'Other(s)'.

- In the 'CORRECTION REQUEST' section, check the tax year applicable to your correction request, repeating the selection process as above.

- Fill in your employee ID, last name, and first name in the respective fields.

- Provide your complete address, including apartment number, city, state, and zip code.

- Enter your contact phone number in the provided field to ensure you can be reached if additional information is needed.

- For W-2 correction requests specifically, describe the error that prompted the correction request briefly in the designated area.

- Review your entries for accuracy, particularly your address, as this will be used for mailing any requested forms.

- Once you have completed the form, email it to W2unit@schools.nyc.gov or fax it to the W-2 Unit at 718-935-3262, as instructed.

- After submitting, retain a copy of the form for your records and await confirmation or further instructions regarding your request.

Start completing your NY 1095C/W-2 Duplicate Request And Information Correction Form online today for a smoother, more efficient process.

IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is a document your employer may have sent you this tax season (or will be sending you soon) in addition to your W-2 wage form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.