Loading

Get Mo Mo-crp 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-CRP online

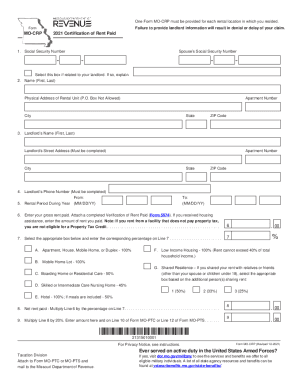

Filling out the MO MO-CRP form online is a crucial step for individuals seeking to claim property tax credits based on their rented accommodation. This guide provides a clear step-by-step approach to help users navigate the form efficiently and accurately, ensuring all necessary information is included to avoid delays or denials in claims.

Follow the steps to successfully complete the MO MO-CRP online.

- Click the ‘Get Form’ button to access the MO MO-CRP and open it for editing.

- Enter your social security number in the designated field at the top of the form.

- If applicable, select the box related to your landlord; if selected, provide a concise explanation.

- Fill in your name, including first and last name.

- Input the physical address of the rental unit. Note that a P.O. Box is not accepted; include the apartment number, city, state, and ZIP code.

- Provide your landlord's full name along with their street address, including apartment number, city, and state. Ensure this section is complete.

- Input the landlord's phone number in the specified field.

- Indicate the rental period by entering the start and end dates of the year you resided in the unit.

- Enter your gross rent paid during the rental period. Remember to attach the Verification of Rent Paid (Form 5674) to your submission.

- If applicable, select the box that corresponds with your type of rental arrangement and enter the respective percentage.

- Calculate your net rent paid by multiplying the amount from the gross rent by the percentage you entered.

- Calculate the subsequent amounts as instructed on the form, including multiplying the net rent by 20%.

- Review all information for accuracy, then save your changes. After completing the form, you can download, print, or share it as needed.

Start filling out the MO MO-CRP online to ensure your property tax credit claim is processed without delay.

Related links form

A Property Tax Circuit Breaker is a tax refund in the United States given to low income individuals and families whose property tax liability is a large percentage of their yearly income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.