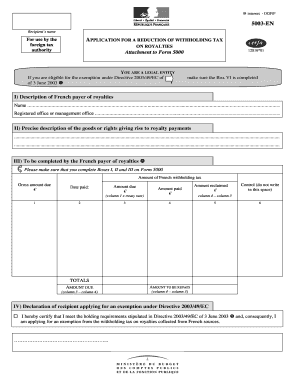

Get Tax Form 5003 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Tax Form 5003 online

How to fill out and sign Tax Form 5003 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The creation of legal documents can be costly and time-consuming. However, with our pre-designed online templates, the process becomes easier.

Now, filling out a Tax Form 5003 takes a maximum of 5 minutes. Our state-specific online forms and straightforward instructions eliminate human errors.

Send instantly to the recipient. Use the quick search and advanced cloud editor to produce an accurate Tax Form 5003. Eliminate the routine and create documents online!

- Locate the template from the catalog.

- Fill in all required details in the necessary fields.

- The user-friendly drag-and-drop interface enables you to add or move fields.

- Ensure everything is filled out correctly, with no spelling mistakes or missing sections.

- Add your e-signature to the document.

- Simply click Done to save the changes.

- Save the documents or print your PDF version.

How to modify Get Tax Form 5003 2020: tailor forms online

Place the appropriate document management tools at your disposal. Implement Get Tax Form 5003 2020 with our trustworthy solution that includes editing and eSignature features.

If you wish to fill out and sign Get Tax Form 5003 2020 online effortlessly, then our online cloud-based option is the perfect choice. We provide a comprehensive template-based inventory of ready-to-use forms that you can edit and complete online. Furthermore, there is no need to print the document or engage third-party services to render it fillable. All necessary functionalities will be available for your use once you access the document in the editor.

Let’s look into our online editing tools and their primary features. The editor boasts an intuitive interface, so it won't take much time to learn how to use it. We’ll explore three main components that enable you to:

Besides the features mentioned above, you can secure your document with a password, insert a watermark, convert the file to the necessary format, and much more.

Our editor simplifies the process of completing and certifying the Get Tax Form 5003 2020. It allows you to perform nearly everything involved in managing documents. Additionally, we consistently ensure that your experience modifying files is secure and adheres to major regulatory standards. All these features enhance your enjoyment of using our tool.

Obtain Get Tax Form 5003 2020, make the required edits and adjustments, and download it in the preferred file format. Give it a try today!

- Alter and annotate the template

- The top toolbar is equipped with features that allow you to emphasize and obscure text, without images and graphics (lines, arrows, checkmarks, etc.), add your signature, initialize, date the document, and more.

- Arrange your documents

- Utilize the toolbar on the left if you desire to reorder the document or/and remove pages.

- Make them shareable

- If you want to enable the template to be fillable for others and share it, you can utilize the tools on the right to add various fillable fields, signature and date, text box, etc.

Related links form

To tax yourself as an independent contractor, you need to calculate your total earnings and deduct any allowable business expenses. Utilize Tax Form 5003 to report this income accurately. Setting aside a portion of your earnings for taxes can prevent surprises at tax time. Uslegalforms can provide templates and resources to simplify this process for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.