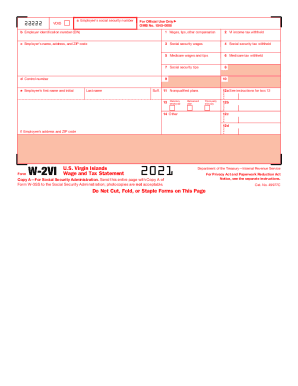

Get Irs W-2vi 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-2VI online

How to fill out and sign IRS W-2VI online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Confirming your earnings and declaring all the crucial tax papers, including IRS W-2VI, is a US citizen?s exclusive responsibility. US Legal Forms helps make your taxes management more accessible and accurate. You can get any legal samples you want and complete them electronically.

How to prepare IRS W-2VI on the web:

-

Get IRS W-2VI within your browser from any device.

-

Gain access to the fillable PDF document with a click.

-

Start completing the template field by field, using the prompts of the advanced PDF editor?s interface.

-

Accurately input textual information and numbers.

-

Press the Date field to set the actual day automatically or alter it manually.

-

Use Signature Wizard to make your customized e-signature and sign within minutes.

-

Check IRS guidelines if you still have any questions..

-

Click on Done to save the edits..

-

Proceed to print the document out, download, or send it via E-mail, SMS, Fax, USPS without quitting your web browser.

Keep your IRS W-2VI safely. You should ensure that all your appropriate paperwork and data are in are in right place while remembering the due dates and taxation regulations established by the Internal Revenue Service. Do it easy with US Legal Forms!

How to edit IRS W-2VI: customize forms online

Pick a reliable document editing option you can trust. Edit, execute, and certify IRS W-2VI securely online.

Very often, modifying documents, like IRS W-2VI, can be a challenge, especially if you received them online or via email but don’t have access to specialized tools. Of course, you can use some workarounds to get around it, but you can end up getting a form that won't fulfill the submission requirements. Using a printer and scanner isn’t an option either because it's time- and resource-consuming.

We offer a smoother and more efficient way of completing forms. A rich catalog of document templates that are easy to edit and certify, and then make fillable for others. Our platform extends way beyond a set of templates. One of the best parts of using our option is that you can revise IRS W-2VI directly on our website.

Since it's a web-based solution, it spares you from having to get any application. Additionally, not all company rules permit you to download it on your corporate computer. Here's the best way to effortlessly and securely execute your paperwork with our solution.

- Click the Get Form > you’ll be immediately taken to our editor.

- As soon as opened, you can kick off the editing process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your document.

- Pick the date field to include a specific date to your template.

- Add text boxes, graphics and notes and more to complement the content.

- Use the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to create and add your legally-binding signature.

- Hit DONE and save, print, and share or get the output.

Forget about paper and other ineffective ways of modifying your IRS W-2VI or other documents. Use our tool instead that combines one of the richest libraries of ready-to-customize forms and a powerful document editing option. It's easy and secure, and can save you lots of time! Don’t take our word for it, give it a try yourself!

Get form

Health Savings Account Change In 2018 Could Trip Up Some Consumers. Money deposited in a health savings account is tax-deductible, grows tax-free and can be used to pay for medical expenses. The annual maximum allowable contribution to an HSA is slightly lower for some people this year.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.