Loading

Get Gatt Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GATT Declaration online

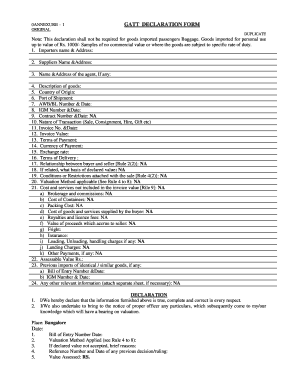

Filling out the GATT Declaration correctly is essential for the importation process. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the GATT Declaration form online

- Click ‘Get Form’ button to obtain the GATT Declaration and open it in the editor.

- In the 'Importer's name & address' section, enter the complete details of the importer responsible for the goods.

- Provide the 'Supplier's name & address' by filling in the information of the supplier from whom the goods are being imported.

- If applicable, include the 'Name & address of the agent' who will represent the importer.

- Describe the goods in detail in the 'Description of goods' section to ensure clarity in the import.

- Fill in the 'Country of origin' to indicate where the goods were produced or manufactured.

- Enter the 'Port of shipment' to specify the location where the goods were shipped from.

- Provide the 'AWB/BL number & date,' which refers to the air waybill or bill of lading details.

- Fill out the 'IGM number & date,' which indicates the inland goods manifest pertinent to the shipment.

- Enter the 'Contract number & date' if applicable; otherwise, note as N/A.

- Specify the 'Nature of transaction' (e.g., sale, consignment, hire, gift).

- Provide the 'Invoice number & date' as indicated on the invoice related to the import.

- Enter the 'Invoice value' to indicate the total cost of the goods as reflected on the invoice.

- Fill in the 'Terms of payment' related to the transaction.

- Specify the 'Currency of payment' used for the transaction.

- Indicate the 'Exchange rate' that applies to the transaction.

- Fill in the 'Terms of delivery' to clarify how the goods are being delivered.

- If applicable, indicate the 'Relationship between buyer and seller'; otherwise, note as N/A.

- If the buyer and seller are related, explain the basis of declared value; otherwise, indicate N/A.

- State any 'Conditions or restrictions attached with the sale'; if not applicable, note as N/A.

- Determine the 'Valuation method applicable' according to the relevant rules; state N/A if not applicable.

- Detail the 'Cost and services not included in the invoice value' and specify any excluded costs.

- Input the 'Assessable value' in Rs. for the customs assessment.

- If there were any previous imports of identical or similar goods, record the 'Bill of entry number & date' and 'IGM number & date.'

- Include any 'Other relevant information' in this section; if necessary, attach a separate sheet.

- Read the declaration statement carefully. Confirm that all provided information is true and accurate, and sign if required.

- Finally, save changes, download, print, or share the form as necessary.

Complete the GATT Declaration online and ensure your import documentation is accurate and compliant.

Yes, GATT remains in effect today as part of the World Trade Organization's agreements. It continues to influence global trade policies and practices. Staying informed about the Gatt Declaration and its implications can help you navigate today's trade landscape successfully.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.