Loading

Get In Dlgf Hc10 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DLGF HC10 online

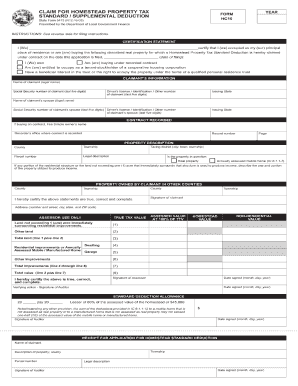

Completing the IN DLGF HC10 form online is essential for claiming the homestead property tax standard deduction in Indiana. This guide provides clear and detailed instructions to help users navigate each section of the form with ease.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the certification statement. Indicate your name, verify your occupancy status, and include the date your application is filed.

- In the 'Claimant’s Information' section, provide your legal name, Social Security number, and driver’s license or identification number, including the last five digits. Repeat these details for your spouse if applicable.

- Complete the 'Contract Recorded' section if you are buying under a contract. Here, include the name of the fee simple owner, the recorder's office where the contract is filed, and the record number and page.

- In the 'Property Description' section, provide details about the county, township, parcel number, and the taxing district. Select whether the property is real property or an annually assessed mobile home.

- If applicable, describe any portion of the residential structure or land used to produce income.

- List any property you own in other counties, along with relevant details such as county and township.

- Finalize the application by signing where indicated. Include your address, ensuring that your information is accurate and complete.

- Once you have filled in all required sections, you can save changes, download the completed form, print it for your records, or share it as needed.

Complete your homestead property tax standard deduction forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

There are no immediate plans for the Indiana homestead exemption to go away, as it plays a crucial role in supporting homeowners. The IN DLGF HC10 program continues to assist eligible property owners, but it is advisable to stay informed about any legislative changes. Monitoring updates from state officials will help you remain aware of your rights and benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.