Get Il Ptax-342-r 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL PTAX-342-R online

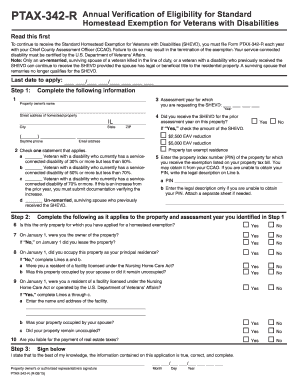

This guide provides detailed instructions for completing the IL PTAX-342-R, the Annual Verification of Eligibility for Standard Homestead Exemption for Veterans with Disabilities. Whether you are filing for the first time or need to reapply, this comprehensive step-by-step process will help ensure you successfully submit your application online.

Follow the steps to fill out the IL PTAX-342-R form effectively.

- Press the ‘Get Form’ button to access the IL PTAX-342-R online and open it in the editor.

- Complete your personal information in the appropriate fields. Enter the property owner’s name, the street address of the homestead property, the assessment year, and the city, state, and ZIP code.

- Indicate if you received the Standard Homestead Exemption for Veterans with Disabilities (SHEVD) for the prior assessment year on this property by selecting 'Yes' or 'No.' If 'Yes,' specify the amount.

- Select the statement that applies to your situation regarding your disability status, ensuring to check the appropriate box that corresponds with your service-connected disability percentage.

- Enter the Property Index Number (PIN) from your property tax bill. If you cannot obtain your PIN, write the legal description of your property.

- Answer questions regarding other properties, residency status, and the occupancy of the property. Provide details as per the prompts.

- Sign and date the form to declare that the information provided is accurate to the best of your knowledge.

- After completing all sections, you can save changes, download, print, or share the IL PTAX-342-R to submit it to your Chief County Assessment Officer for processing.

Start the process now to ensure you secure your Standard Homestead Exemption for Veterans with Disabilities online.

Get form

Related links form

To fill out a withholding exemption form, ensure you have your personal information and understand the requirements regarding your income situation. Carefully follow the provided instructions on the form. For tax-related questions, the IL PTAX-342-R can serve as a helpful reference for understanding exemptions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.