Loading

Get Il Mfut-12 1997-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL MFUT-12 online

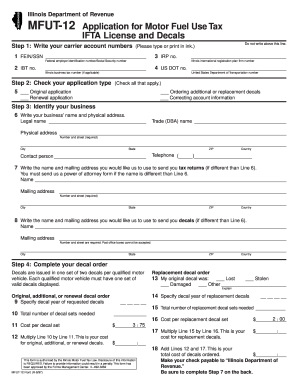

The IL MFUT-12 form is essential for individuals and businesses seeking to apply for Motor Fuel Use Tax, including obtaining IFTA licenses and decals. This guide will provide clear, step-by-step instructions to help users complete the IL MFUT-12 online accurately and efficiently.

Follow the steps to complete your IL MFUT-12 online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Provide your carrier account numbers in the designated fields. This includes your FEIN or SSN, IRP number, IBT number, and US DOT number.

- Check the type of application you are submitting. Options include original application, ordering additional or replacement decals, correcting account information, or renewal application.

- Clearly identify your business by entering the legal name, trade name (if applicable), physical address, and contact details. If the mailing address differs, provide that information as well.

- For decal orders, specify the decal year required, the total number of sets needed, and the cost per decal set. Complete the section for replacement decal orders if necessary.

- Indicate the type of business ownership, and list any owners or corporate officers as required.

- Define your fuel types and operations by checking the type of fuels utilized and marking the jurisdictions in which you operate and maintain bulk fuel storage.

- Sign the application, including your title and contact information, to affirm the truthfulness of the provided data.

- Finally, save your completed form, and choose from the options to download, print, or share the document as needed.

Complete your IL MFUT-12 form online today for efficient processing.

Related links form

When answering 'Are you exempt from withholding?', evaluate your tax situation based on income and filing status. If you are eligible for an exemption, meaning you owe no taxes or had no tax liability last year, simply mark 'yes' and provide the necessary documentation. Otherwise, answer 'no' and ensure your IL MFUT-12 information accurately reflects your current withholding needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.