Get Ca Dtt Affidavit 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DTT Affidavit online

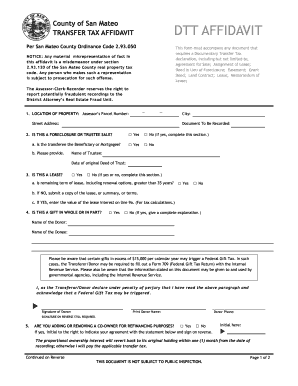

The CA DTT Affidavit is a crucial document that accompanies various transactional agreements involving the transfer of property in San Mateo County. This guide provides a clear, step-by-step approach to filling out the affidavit online, ensuring that you accurately complete each section with ease and confidence.

Follow the steps to fill out the CA DTT Affidavit online effectively.

- Press the ‘Get Form’ button to access the CA DTT Affidavit, which will open in your editor for completion.

- Begin by entering the location of the property, including the Assessor’s Parcel Number, city, and street address. Specify the document to be recorded.

- Indicate whether this transaction is a foreclosure or trustee sale by selecting 'Yes' or 'No.' If 'Yes,' provide the name of the trustee and the date of the original deed of trust.

- State whether this is a lease by selecting 'Yes' or 'No.' If 'Yes,' check if the remaining term is over 35 years. Provide the required information based on your answers.

- Declare if the transfer is a gift, listing the donor's and donee's names as necessary. Acknowledge the potential federal gift tax implications.

- Answer whether you are adding or removing a co-owner for refinancing purposes. If 'Yes,' initial the statement and sign on the reverse side as indicated.

- Specify if you are moving title into or out of a trust, detailing the trust's name and other pertinent trustee information.

- If claiming that no transfer tax is due, provide a detailed explanation of the reason and nature of the transaction.

- Indicate if this transfer is between legal entities, supplying necessary documentation, and identifying ownership percentages.

- Complete the taxable transactions section, calculating the tax due based on the provided valuation.

- Finally, affirm the document's accuracy by signing as either the transferee, transferor, or representative. Include relevant contact information and the execution date.

Start filling out the CA DTT Affidavit online for a smooth transaction experience.

Get form

Related links form

Typically, the seller is responsible for paying the real estate transfer tax in California. However, this can also be a matter of negotiation between the buyer and seller, based on their agreement. When using a CA DTT Affidavit, it’s essential to make clear who will handle the transfer tax expenses. A thorough discussion before finalizing deals can prevent any confusion regarding this financial obligation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.